Introduction

This will be the first in a series of articles showing you how to model a public company.

We’re going to build a standalone model for Slack Technologies, Inc. (NYSE: WORK). A standalone model is exactly what it sounds like: a financial model for a given company without any assumed transactions (e.g., acquisition, dividend recap, etc.). Oftentimes, a standalone model is the first building block in a larger financial analysis exercise. For example, if a bank is hired to help a company review its strategic alternatives, one of the first steps is working with management to build a standalone model. The standalone model serves as the company’s base case, which all strategic alternatives are then compared to.

Likewise, public markets investors model public companies in order to project financial results and evaluate investment opportunities. For private equity investors, building a rigorously tested operating model is one of the key workstreams in any deal. Knowing how to build rock-solid standalone models is a foundational skill for investment banking, private equity, and hedge fund professionals.

This article will walk you through building a public market overview (PMO), which is the first step in any standalone model for a public company. A public market overview calculates a company’s equity value and enterprise value, along with basic trading multiples.

Future articles in this series will walk you through building the full standalone model and accompanying operating cases. This is step one.

Getting Started

We recommend you start from a blank Excel workbook and try to follow the steps below. But if you prefer, here’s the completed Excel file.

1) Create Cover Tab

First, we’re going to create a cover tab. Our cover tab looks like this:

A few things to point out:

- Below the cover area, we wrote our project code name (“WORK”) in cell F47. We’re naming this cell

PROJECT.To name a cell, you press Ctrl + F3. When you name a cell, you can then refer to it anywhere in the workbook using its new name (in this case,

PROJECT).Word to the wise: don’t overuse this functionality. If you have more than 10 named cells in your model, you’re doing too much.

- The title in the cover area is actually a formula using our project code name. The formula is:

=”Project “&PROJECT

- Similarly, the date / timestamp below the title is created using the formula:

=now()

2) Create PMO Tab

Next, we’re going to create a new tab for our public market overview (PMO). Again, a public market overview calculates a company’s equity value, enterprise value, and implied trading multiples. This might sound simple, but calculating equity and enterprise values can involve a surprising degree of nuance.

- Okay, let’s create a new tab. The shortcut to create a new Excel tab is SHIFT + F11.

- Now, let’s rename the new tab

PMO. The shortcut to rename an Excel tab is: ALT > H > O > R. - Let’s apply some basic formatting to our new tab. In the upper leftmost cell, we’ll reference the project name again.

= “Project “&PROJECT

- Below the project name, let’s put a page header - in this case, “Public Market Overview (PMO)”

Your new PMO tab should look like this:

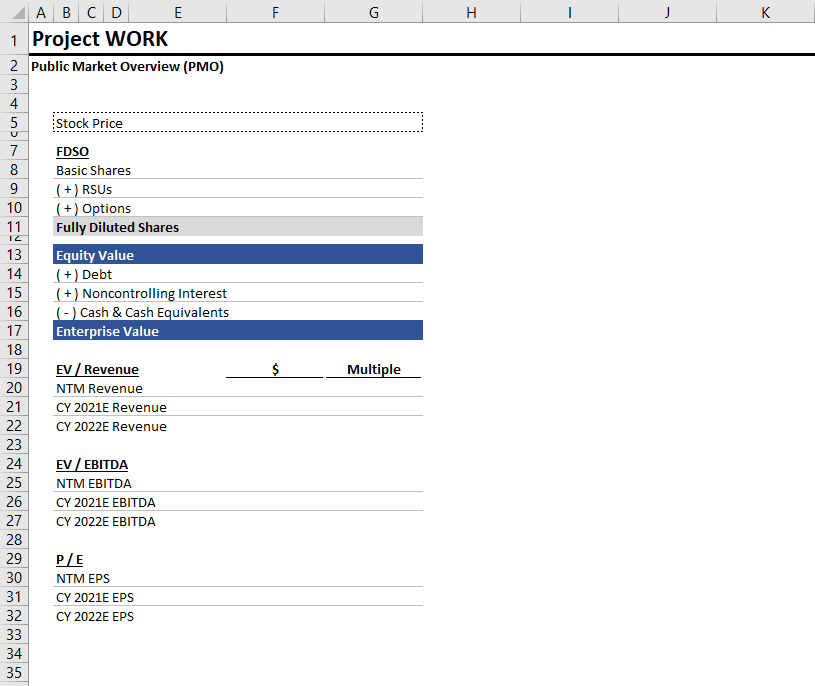

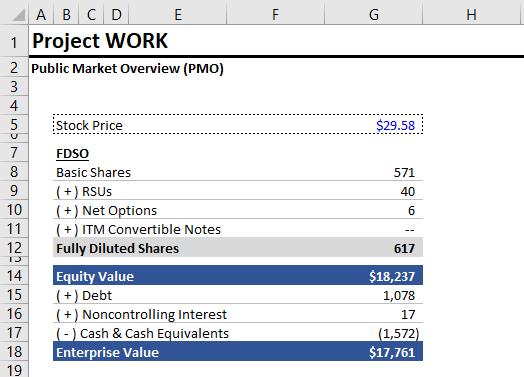

3) Add PMO Layout

Let’s add the basic structure of our PMO. Remember - we’ll be calculating equity value, enterprise value, and trading multiples for Slack.

How do we calculate equity value for a public company? Pretty simple, we multiply the number of shares by the stock price. We’ll need (i) the stock price and (ii) the fully diluted share count.

How do we calculate enterprise value for a public company? We take the equity value, and we add net debt. We’re already calculating the equity value (above), but we’ll need to look at Slack’s latest filings in order to determine the net debt.

How do we calculate trading multiples? (If you really have no idea, this is not the right tutorial series for you.) We’re going to divide equity value and enterprise value, respectively, by various financial metrics for Slack, such as revenue, EBITDA, and net income. The exact metrics and multiples we use will depend on the company’s financials.

Here’s what the outline of your PMO should look like:

Stock-Based Compensation

You’ll notice that we’re adding options & RSUs to basic shares in order to calculate the fully diluted shares outstanding (FDSO). Most public companies offer some form of stock-based compensation to employees, and options and RSUs are two common varieties. When we go through Slack’s financial statements, we may discover additional share awards, or we may find out that Slack doesn’t have options or RSUs. Ultimately, we need the fully diluted share count, so that we can calculate accurate equity and enterprise values.

Some theory - why we’re focused on counting every last share…

A company’s stock price gives us the implied equity value per share. We must assume that the market is relatively efficient. Therefore, the market is doing the same basic math as us, and knows exactly how many outstanding shares there are, including from stock-based compensation. Armed with this knowledge, the market is then giving us a price, which implicitly is the most diluted (lowest) value. If we don’t include all shares in our equity value calculation, we’re undervaluing the given company, because we’re multiplying the market price (reduced by share awards) by a half-baked share count.

Noncontrolling Interest

Noncontrolling interest represents the portion of any subsidiaries not owned by Slack. For example, if Slack bought 80% of XYZ Co three years ago, all of XYZ Co’s assets, liabilities, revenues, expenses, and cash flows would be included in Slack’s consolidated financials. The outstanding 20% of XYZ Co - not owned by Slack - would be included in Slack’s balance sheet as noncontrolling interest.

Noncontrolling interest is included as a debt-like item in the build from equity to enterprise value. It’s treated like debt, because it represents a claim on Slack’s consolidated net operating assets that is not included in Slack’s equity value. Remember, the noncontrolling interest is the portion NOT owned by Slack and, therefore, not indirectly owned by Slack’s shareholders.

More theory - what does enterprise value represent?

This concept is often poorly explained. I’ll try to do a better job here. Enterprise value represents the aggregate value of a business, or collection of assets, irrespective of capital structure.

For example, when you buy a house, you fund the purchase using some combination of debt and down payment. The enterprise value for the house is the total amount of money transferred to the seller. Enterprise value ignores capital structure - it is purely a measure of aggregate value.

4) Searching the Financials

Now the fun begins. Reading and searching a company’s financials deserves its own (lengthy) article series. We’ll do our best to cover the essentials below.

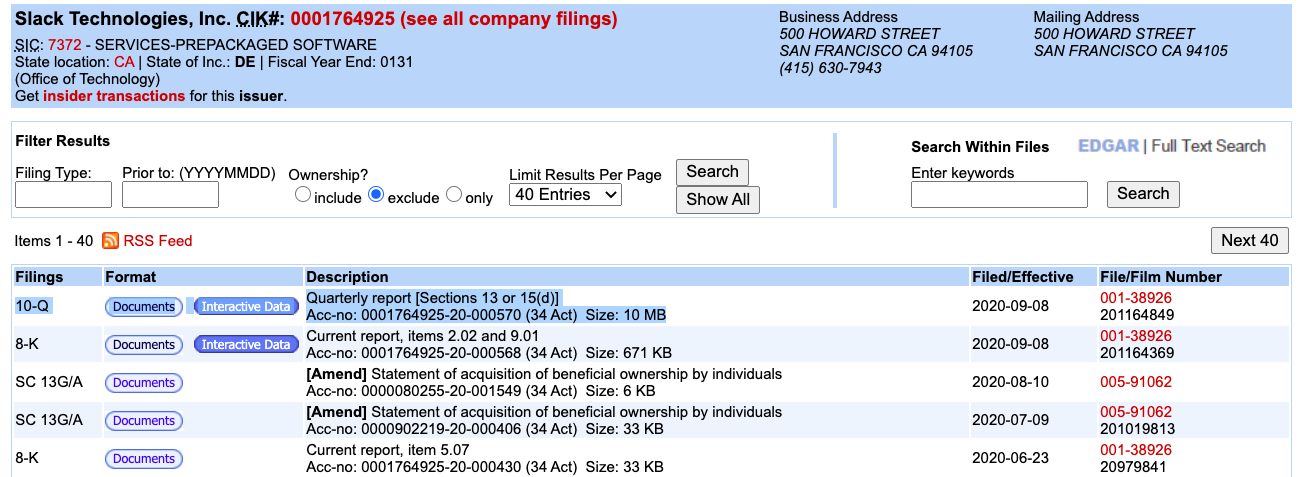

SEC Filings

Since we’re evaluating a US-listed company (Slack), we’ll go to the SEC’s website to pull the filings. A lot of people are intimidated by the SEC website, due to its slightly clunky interface, but once you get the hang of it, it’s fast and easy. Personally, I feel more comfortable pulling filings directly from the source - and in the US, that’s EDGAR, the SEC’s filings website.

I never remember the website URL, so I always just google “SEC EDGAR.” The first result is the correct link. On the left side of the EDGAR webpage, you should see a search box labeled Company and Person Lookup. That’s where you enter the ticker. So let’s type in Slack’s ticker, WORK, and we’ll get going.

You should now be on Slack’s EDGAR page, and you should see “Slack Technologies, Inc.” at the top (here’s the link in case you want to double-check).

Filings are listed in reverse chronological order (most recent filings at the top), and the number-and-letter symbols in the leftmost column represent filing types. You’ll mainly be interested in 10-Ks (annual financials), 10-Qs (quarterly financials), and 8-Ks (periodic investor updates), but here’s a complete list of filing types. I wouldn’t recommend reading this list, unless you have an unanswered question. For example, if you see an unusual form code and want to know what it is, try google first. If you can’t find a succinct answer quickly, then pop open this list and Ctrl + F.

As I mentioned, 10-Ks, 10-Qs, and 8-Ks are where you’ll spend most of your time. 10-Ks provide the most comprehensive information, and they’re filed annually. You can think of 10-Qs as leaner, less filling versions of the 10-K. 10-Qs are filed quarterly. This guide on how to read a 10-K, provided by the SEC, is pretty thorough without making your eyes bleed (at least mine didn’t). If you’re new to filings research, it’s a good place to start.

When building a PMO, you want to locate the latest 10-Q or 10-K, which should have all of the information you need. Ideally, the latest 10-Q or 10-K will be one of the first filings listed, as is the case here (as of November 25, 2020). See below:

It’s better (for you) if the latest 10-Q / 10-K is near the top of the list, because then you have to check fewer filings to ensure nothing material has changed. Remember - 8-Ks contain investor updates, so sometimes you can run into situations, in which an important 8-K is released after the latest 10-Q / 10-K. By default, you should check every filing above the latest 10-Q / 10-K, and it’s also a good idea to check any 8-Ks directly below the latest 10-Q / 10-K. You don’t want to miss something important. Anyways, we’re in luck. No subsequent 8-Ks, and the latest 10-Q should have everything we need.

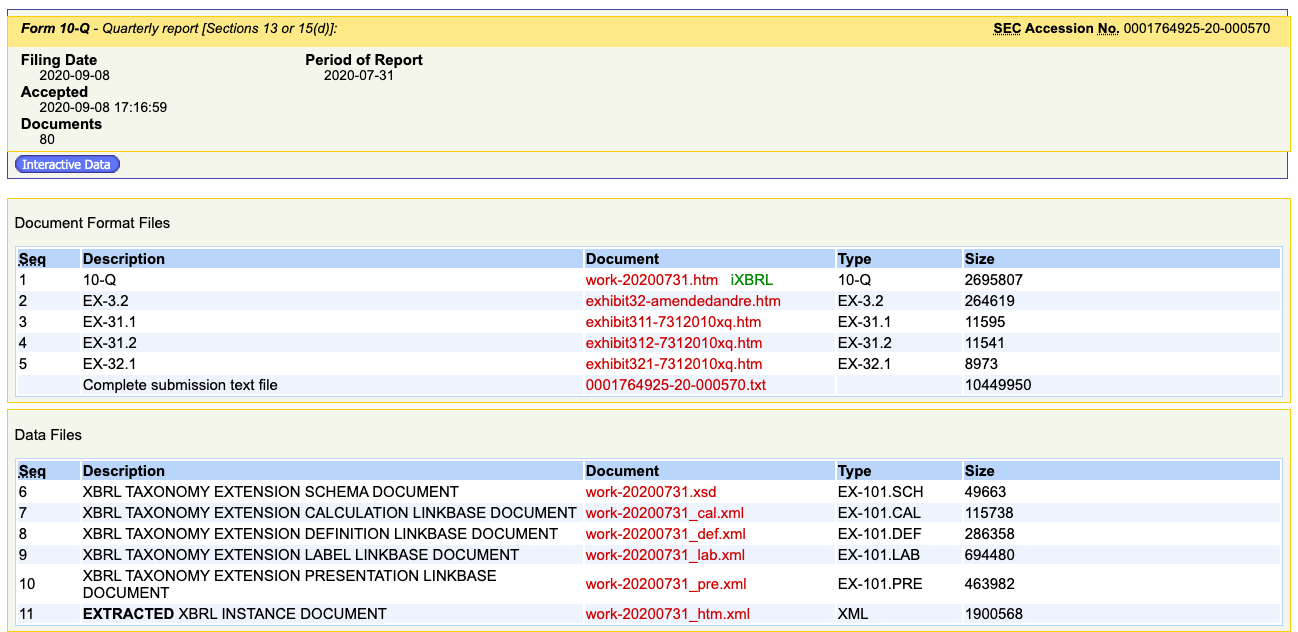

10-Q and Exhibits

Let’s click on that top 10-Q. You should see this menu:

The first link in the table (here, it says “10-Q”) is the main filing. We’ll go to that in a second.

The exhibits listed below the filing contain various legal documents. You can ignore these unless you’re hunting for something specific. For example, the first exhibit (“EX-3.2”) contains Slack’s latest bylaws. These are the legal rules that govern the election of company directors, stockholders’ meetings, etc. If you work at an activist hedge fund, you might find these interesting. If you work at a bank, you’ll probably never read these.

Anyways, moving on. Let’s click the first link, which will give us the latest 10-Q.

Finding the Data We Need

Now, I’m going to go through and show you where to find each piece of information we need for the PMO. As we find specific pieces of information, you can add this data to your Excel file.

As a reminder, we’re looking for:

- Basic share count

- Dilutive equity awards

- Total cash and cash-like items

- Total debt and debt-like items

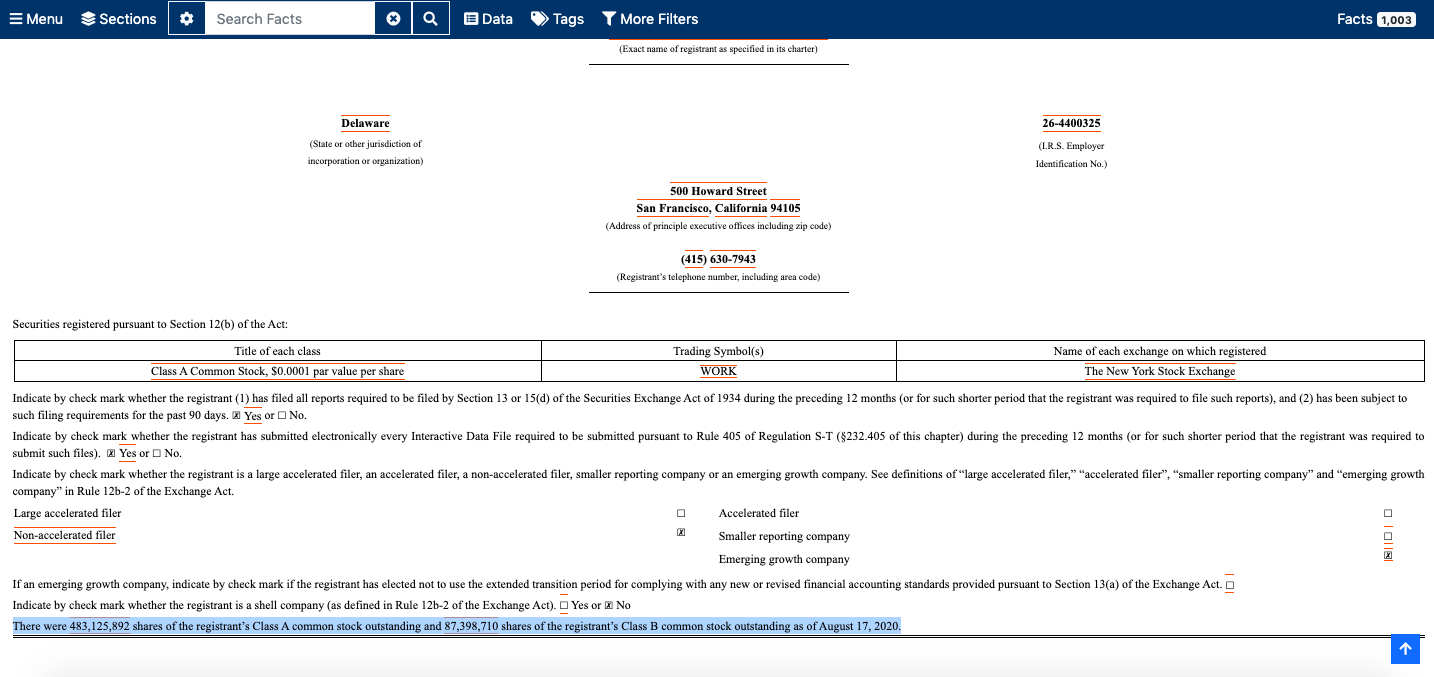

Basic Shares

You can find the basic share count on the cover of any 10-Q / 10-K. This is not the fully diluted number and doesn’t include stock-based compensation. See below:

It looks like Slack has two classes of common stock: Class A common stock and Class B common stock. We’ll need to confirm, but my guess is that the only difference between the two classes is voting rights. The class B shares likely command more votes per share.

Let’s record both values below our PMO for the time being.

Balance Sheet

Cash

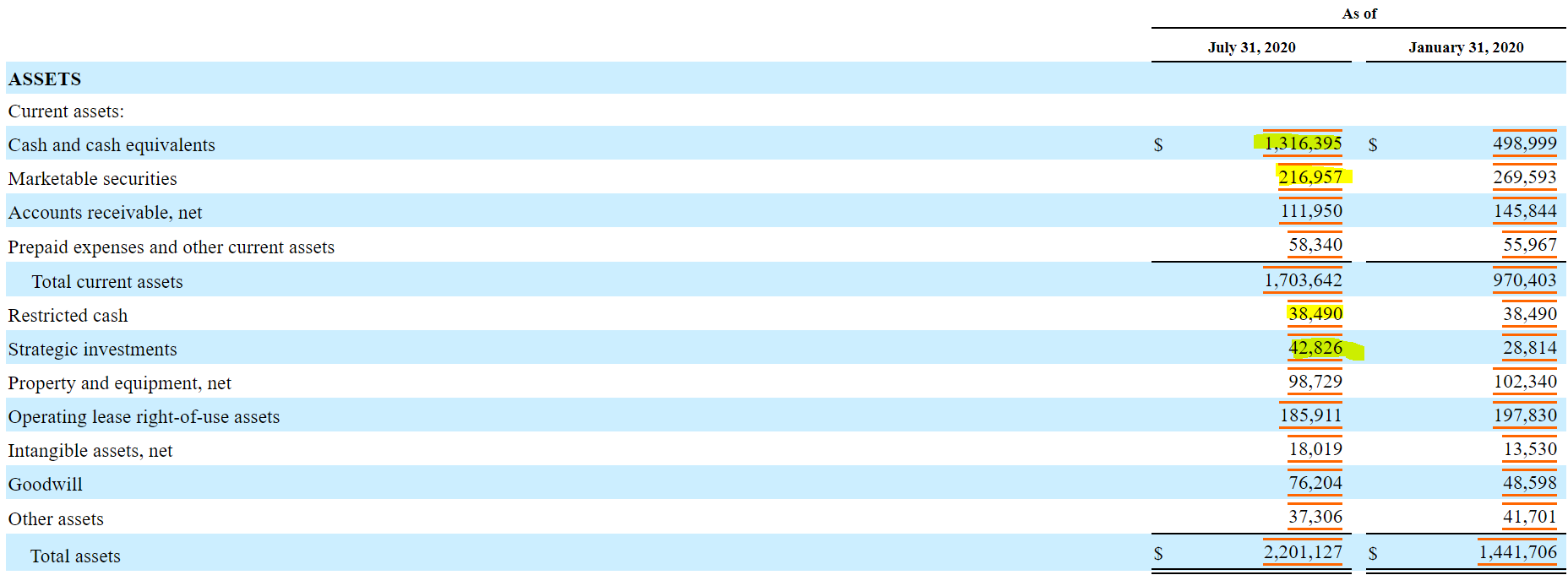

If we continue scrolling through the 10-Q, soon we’ll come to the balance sheet. Note: 10-Qs don’t have as much fluff as 10-Ks. If you’re scrolling through a 10-K, it might take you a little while to get to the balance sheet. The page down key is your friend.

Every balance sheet should include a cash and cash-equivalents line item under current assets. But we still need to read the rest of the balance sheet to ensure we’re not missing anything.

I see four line items we might want to treat as cash ($ in millions):

- Cash and cash-equivalents ($1,316.395)

- Marketable securities ($216.957)

- Restricted cash ($38.49)

- Strategic investments ($42.826)

Cash and cash-equivalents is obviously cash, and marketable securities should likely be included as well. For restricted cash and strategic investments, we’ll need to read the footnotes to confirm.

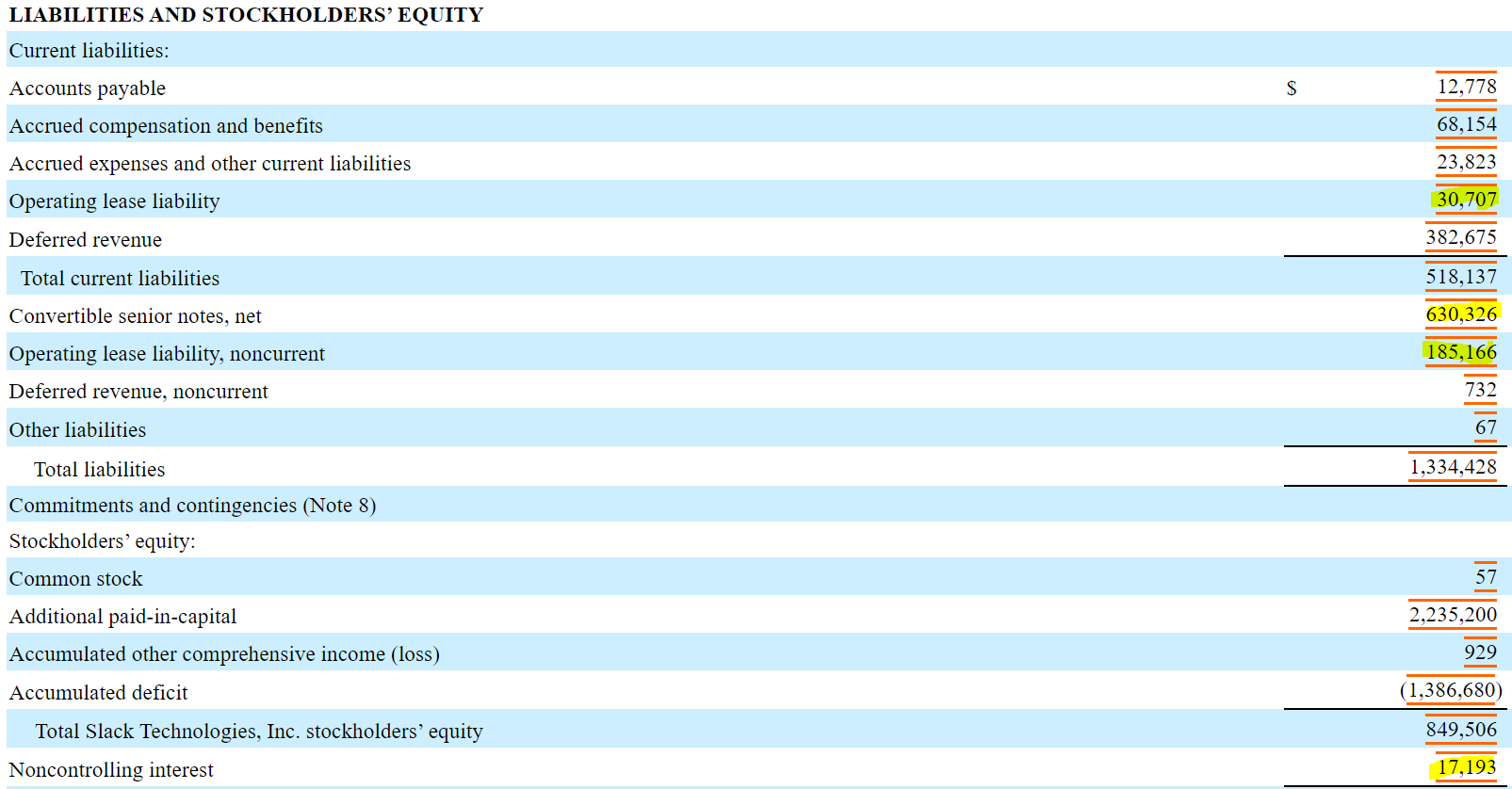

Debt

Before we move on from the balance sheet, let’s identify any debt and debt-like items.

I see several line items we want to include ($ in millions):

- Operating lease liability, current & noncurrent ($215.873)

- Convertible senior notes ($630.326)

- Noncontrolling interest ($17.193)

We’ll need to read more about the operating lease liability and the senior notes. We already discussed why we’re including noncontrolling interest (above).

Income Statement

Now, we can continue scrolling through the document. Glancing at the income statement, we see that Slack has negative operating income, net income, and earnings per share. Therefore, we can delete the EV / EBITDA and P / E multiples from our PMO. Slack’s stock obviously doesn’t trade based on negative multiples. Some industry knowledge confirms this - growth SaaS businesses trade on forward revenue multiples.

SaaS stands for Software as a Service. Here’s a good primer from Salesforce on the SaaS business model.

Into the Footnotes

After adjusting our PMO template, let’s keep scrolling down. Once you get past the financial statements, you’re into the footnotes. In books or the academic setting, footnotes usually contain references or extraneous information. But for financial analysis, footnotes are the most valuable source of information.

Accounting Policies

Usually, one of the first notes is a description of important accounting policies. For public markets investors, this is a must-read section. Accounting gives you a lot of leeway to smooth earnings and game the system. You should read the accounting policies with a skeptical eye to understand what accounting decisions management is making and where they’re applying judgement.

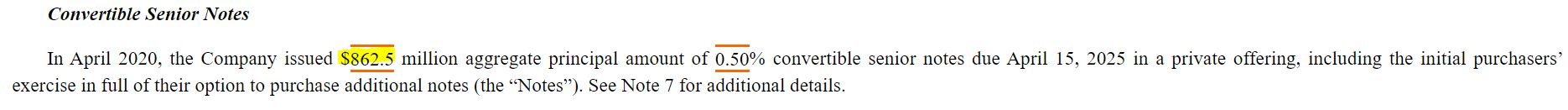

I usually skim this section, but right away I see something useful for our PMO:

The face value of the senior notes is 862.5 million, versus the lower amount on the balance sheet. The balance sheet figure must contain a substantial discount. The blurb in the accounting policies also tells us which footnote has more info (note 7).

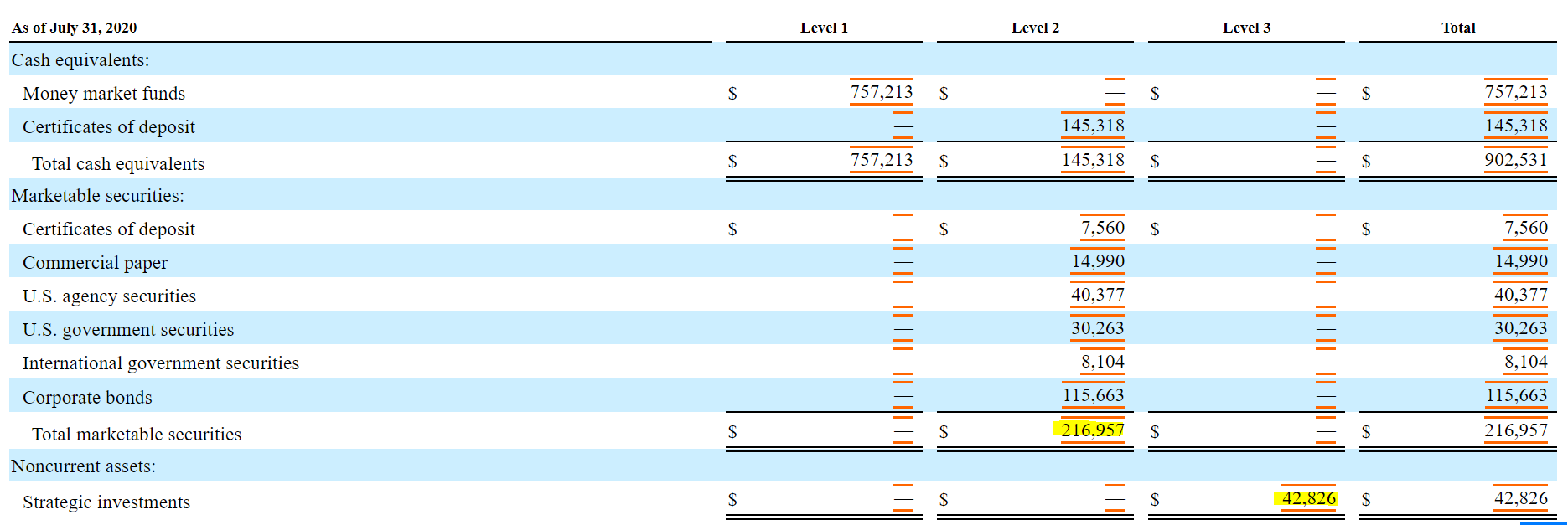

Fair Value Measurements

Continuing to scroll through the footnotes, we come to the Fair Value Measurements section, which details assets recorded at fair value instead of cost. This includes the extra line items we’re considering including as cash-equivalents.

You can see that the marketable securities line item consists of fairly liquid assets: corporate bonds, US government securities, etc. We can treat marketable securities as cash.

Strategic investments, on the other hand, are highly illiquid. Therefore, we will NOT include that line item as cash.

Business Combination

Next, we see a note about Slack’s recent acquisition of Rimeto Inc. It is worth reading any Business Combination notes, because sometimes 10-Qs and 10-Ks include basic financial information for acquisitions that occurred after the balance sheet date. In those cases, the acquired company is not included in the consolidated balance sheet, and we would need to add any acquired cash to the previously noted amounts, etc. Fortunately, the acquisition of Rimeto was completed on June 29 - well before the balance sheet date (July 31).

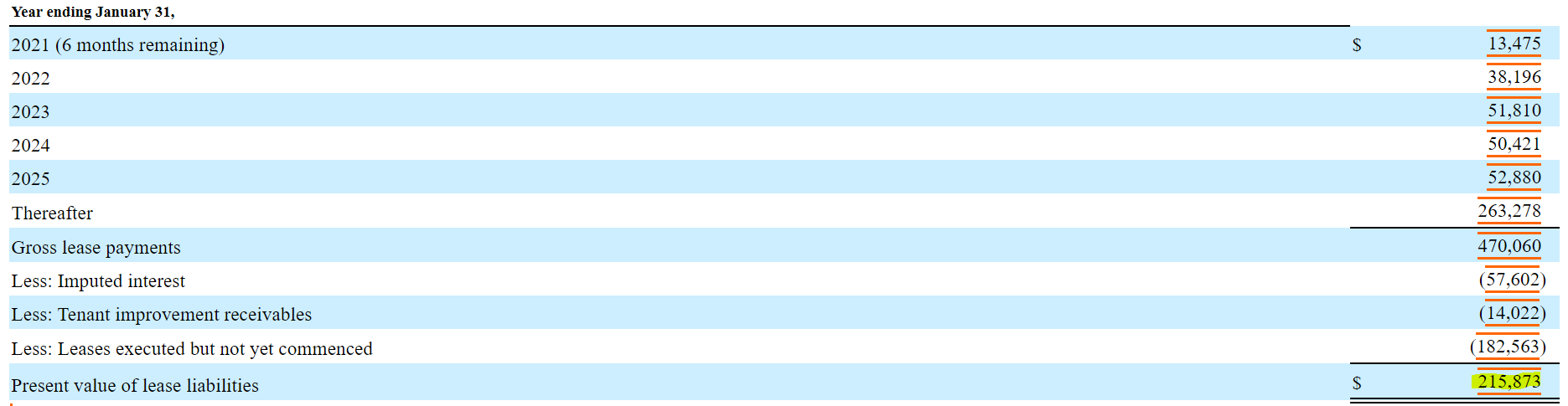

Operating Leases

Eventually we’ll come to the Operating Leases section. As you’ll recall, we noted an operating lease liability on the balance sheet as one of the potential debt-like items, so let’s read this section.

In this case, it looks like the operating lease liability is debt-like, and we should include it in our enterprise value calculation. It is the implied debt financing required to own the leased assets. Historically, leases have been an accounting subject prone to trickery. Some companies use capital leases (effectively, debt + leased assets on the balance sheet); other companies use operating leases to appear asset-light. Capitalizing the operating leases levels the playing field and makes comparison between companies somewhat easier. FASB’s new lease accounting standard (ASC 842) reduces some of the mischief in lease accounting.

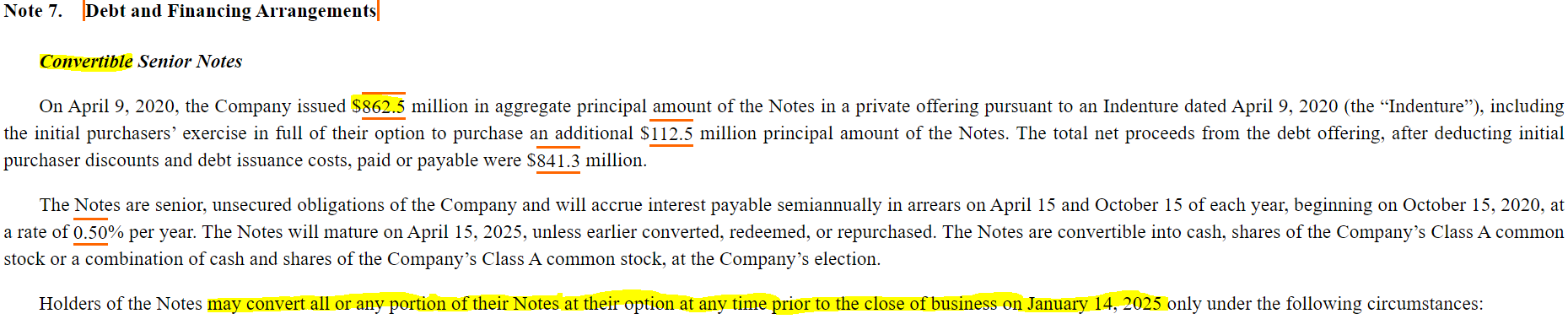

Debt

The next section covers Debt and Financing Arrangements. We definitely want to read this.

Right away, we receive confirmation that the face value of notes is 862.5 million.

We also learn that the notes are convertible to common stock. That means, layered within the debt instrument, is an option for the debtholders to exchange their notes for stock. This requires further inspection, because this debt could increase our diluted share count.

We learn more about the conversion option below:

This means that every $1,000 of debt can be exchanged for 32.2630 shares. If the stock price is greater than $31, we should assume the debt converts to shares, and if the stock price is less than $31, we can treat the notes as normal debt. We’ll need to add a row to the diluted shares section of our PMO to account for the conversion option. We can label this new row: “ITM Convertible Notes” (ITM stands for in the money).

We also learn that Slack has a revolving credit facility.

But it’s completely undrawn:

Commitments and Contingencies

The next section is Commitments and Contingencies. The first blurb tells us that restricted cash ($38.5 million) consists of standby letters of credit for operating leases. Standby letters of credit are essentially cash set aside and guaranteed, by a bank, for payment to a third party. It sounds like these letters of credit are essentially prepaid deposits for lessors. Since we’re counting operating lease liabilities as debt (in our enterprise value calculation), we should also include the corresponding restricted cash. It doesn’t make sense to include one and not the other. By the same logic, if you choose not to include operating lease liabilities as debt, you should not include restricted cash, since it is tied to the leases.

Note on Restricted Cash: As an astute reader pointed out, restricted cash is presented separately on the balance sheet for good reason. Usually, you would not include it in net debt. We had to read the footnotes to discover that it is tied to operating lease liabilities, and therefore, it should be included in our enterprise value calculation. Lenders, however, would not give the company credit for restricted cash, because it’s not generally available to the company - it’s subject to a prior legal claim (operating leases).

Pro Tip: In this tutorial, we’re reading the notes sequentially. But your process doesn’t need to be linear. For example, if you see an odd line item on the balance sheet, you can CTNL + F for more detail.

Checking In

Before continuing to read the notes, let’s assess what we still need to find.

- We have cash and cash-like items.

- We have debt and debt-like items.

- We have basic shares.

- We still need to find any dilutive securities, such as stock options.

Stockholders’ Equity

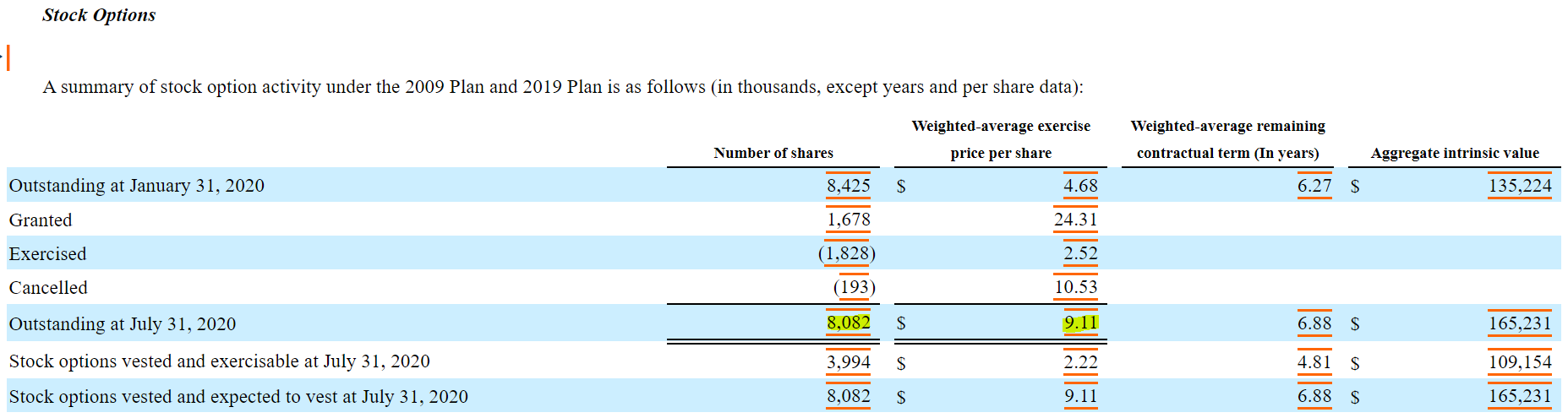

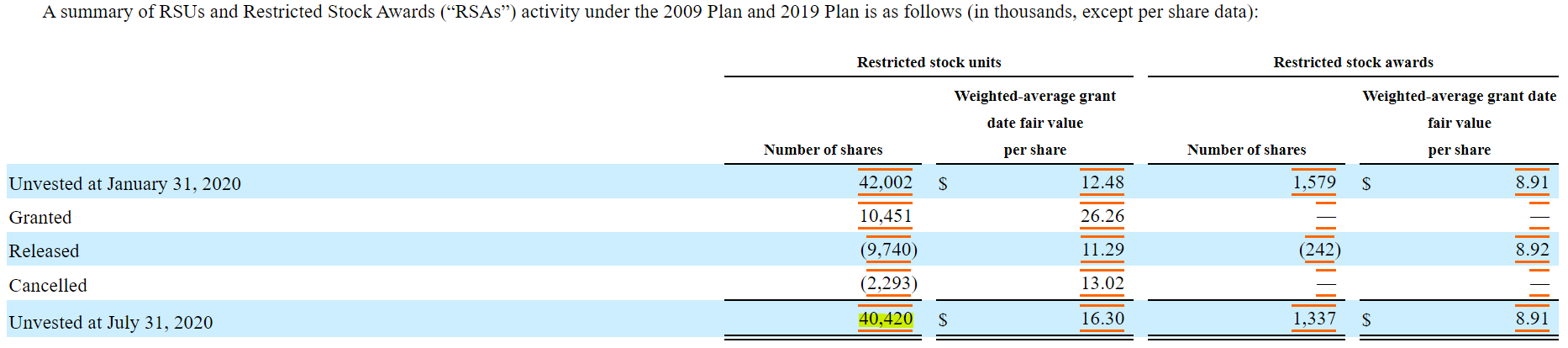

We eventually come to note 9 - Stockholders’ Equity. This section details outstanding options, RSUs, etc.

You’ll notice that there are multiple option counts we could potentially include. I’ll make it simple for you. Always use the total number of outstanding options. You can ignore the vested counts.

In our PMO tab, we’ll record 8.092 million options with a weighted-average strike price of $9.11.

Below the options table, we see a section on Restricted Stock Units and Restricted Stock Awards. These two types of compensation sound similar, but are quite different. Here’s a good overview on the difference between RSUs and RSAs. Essentially, RSUs are not actual shares. They represent a promise to receive shares in the future. But RSAs are full shares, subject to vesting and certain restrictions. Whereas RSUs are not included in the basic share count, since they’re not real shares, RSAs are already part of the basic share count. Therefore, we will add RSUs to the basic share count in order to calculate fully diluted shares outstanding, but we can ignore RSAs since they are already included.

After recording the options and RSUs, we have all the historical information we need for our PMO. At this point, your updated PMO tab should have the following data:

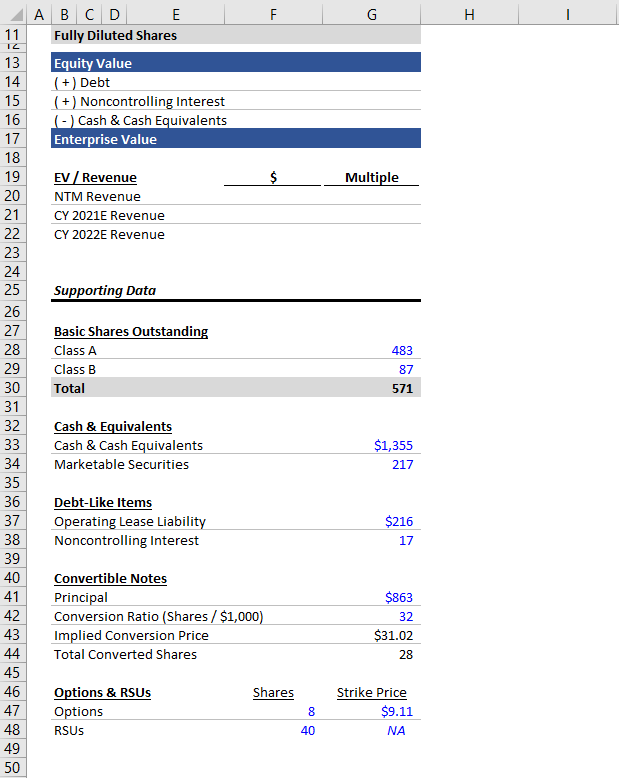

5) Calculate Equity Value

Now we’ll calculate Slack’s equity value.

First, we need a stock price. On November 25, Slack’s stock price rocketed due to acquisition rumors. Therefore, we’ll use the closing stock price on November 24 ($29.58) as our unaffected price.

Next, we need to calculate the diluted shares outstanding.

We can link to the basic share count and RSU count from our supporting data. But we’re going to calculate the net shares from options using the Treasury Stock Method, which relies on the stock price.

Treasury Stock Method

The Treasury Stock Method sounds fancy, but it’s pretty simple. In plain English, the Treasury Stock Method calculates how many options would be exercised at the given stock price. Then, it takes the proceeds from exercised options (the cash paid to convert options to shares) and assumes those proceeds are used to repurchase shares, in order to minimize dilution. The Treasury Stock Method provides the net shares (the number of options exercised, less the number of shares repurchased using option proceeds).

How ‘bout a formula?

= number of options - (option strike price x number of options) / stock price

Remember, we’re taking the number of options exercised. Then, we’re calculating the proceeds from exercising those options (option strike price x number of options). We divide the proceeds by the stock price in order to calculate how many shares can be repurchased.

So the number of net shares equals (i) the number of options exercised, less (ii) the option proceeds divided by the stock price.

Simplified further:

= number of options x (1 - (strike price / stock price))

Try to calculate the net new shares from Slack’s options using this formula. You should be getting 5.59 million new shares.

Convertible Debt

As we discovered in our filings research, Slack has convertible notes. These can be counted as either debt (included in net debt) or additional shares (assuming the debt converted to equity). Therefore, we’ll need to account for the convertible debt in both the diluted shares and net debt.

Here’s what we came up for the diluted shares portion:

= if (stock price > implied conversion price, total converted shares, 0)

Since the unaffected stock price is less than the implied conversion price, the debt should not be converted to equity (it’s worth more as debt).

In summary, the diluted share count consists of basic shares, plus RSUs, plus options (calculated using the Treasury Stock Method), plus any converted shares.

Our equity value is simply the diluted share count multiplied by the stock price ($18,237 million).

6) Calculate Enterprise Value

Now that we have the equity value, the hard part is over. The enterprise value is the sum of (i) the equity value, (ii) total debt, and (iii) noncontrolling interest, less cash and cash equivalents.

We can link the noncontrolling interest value from our supporting data below. Likewise, the cash and cash equivalents value is the sum of cash and marketable securities ($1,572 million).

The debt balance contains the only wrinkle. Again, we need to account for the conversion feature of the debt. If the debt is converted, then the notes will cease to exist. Therefore, our debt balance formula is:

= operating lease liabilities + if (stock price > implied conversion price, 0, debt principal amount)

You should have a debt balance of $1,078 million and an enterprise value of $17,761 million. The enterprise value is less than the equity value, which may seem strange, but just means that the company has more cash than debt.

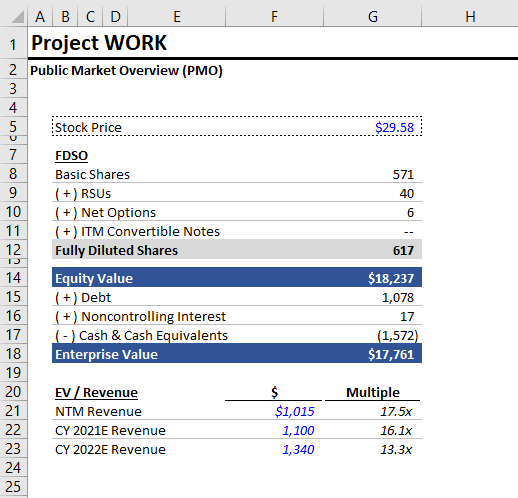

Here’s what the completed equity value and enterprise value calculations should look like:

7) Calculate Trading Multiples

Last, we need to calculate the implied trading multiples. We removed the EBITDA and EPS sections, so we’ll only be calculating the enterprise value / revenue multiples.

Here, you could pull consensus estimates for revenue from a data service, like Bloomberg, CapIQ, or FactSet. In future articles, we’ll pull the forward revenue numbers from our operating model. In the meantime, we’re going to use placeholder numbers:

- For NTM revenue, use $1,015 million.

- For CY 2021E revenue, use $1,100 million.

- For CY 2022E revenue, use $1,340 million.

At this point, calculating the revenue multiples should be easy. Divide the enterprise value by each revenue figure. This is what your completed PMO should look like:

Here is the completed PMO Excel file.

Conclusion

Congrats! You successfully built a public market overview (PMO) for Slack. You have:

- Explored the SEC EDGAR website

- Learned the basics of filings research

- Learned about different types of equity compensation

- Learned the Treasury Stock Method

- Reinforced your understanding of enterprise value and calculating enterprise values for public companies

We’re going to continue this series by building a full standalone model for Slack, complete with flexible operating cases. The next step is pulling Slack’s historical financial and operating data.

Reach out with any questions.