Introduction

This is a quickie. Someone asked, and we’re answering.

Actually, this is long overdue given we’ve named the site after multiple expansion.

This post will strive to:

- define multiple expansion

- explain how the term is relevant to investing, and

- walk through a couple examples

Definition

When a buyer sells an asset for a higher multiple than the multiple that the buyer originally paid, that growth in multiple is called multiple expansion.

The inverse could be called multiple contraction, but the term isn’t commonly used, perhaps because no one likes to highlight that they overpaid.

Simple Example

Let’s walk through an example:

Some years ago, private equity firm Pirate Capital bought a shipping business for a total enterprise value of 100. At the time, the business had 10 of LTM EBITDA. Therefore, Pirate Capital paid a 10x TEV / LTM EBITDA multiple.

Now, the business has 12 of LTM EBITDA, and Pirate Capital sells the business for a total enterprise value of 144, which represents a 12x TEV / LTM EBITDA multiple.

Since the exit multiple (12x) is greater than the entry multiple (10x), there was multiple expansion.

Here’s another:

Pirate Capital bought a sailboat business for a total enterprise value of 110. At the time, the business had 10 of LTM EBITDA. Therefore, Pirate Capital paid a 11x TEV / LTM EBITDA multiple.

Several years later, Pirate Capital sold the business for a total enterprise value of 150 when it had 15 of LTM EBITDA.

Since the exit multiple (10x) was less than the entry multiple (11x), there was multiple contraction.

Context

Ok, who cares? The multiple’s bigger, I get it.

Well, it is just jargon, but multiple expansion is in many ways the alchemy of investing. You take the same business, apply a higher multiple to it, and profit. Think about it - hypothetically, even if the business doesn’t grow at all, as long as the exit multiple is higher, the investors make money.

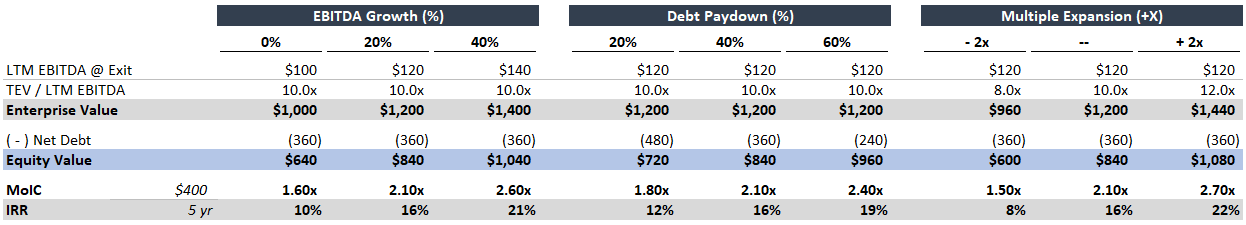

The table below showcases the impact of multiple expansion relative to debt paydown and EBITDA growth in a simple LBO.

Key Assumptions

Initial Investment

- 100 LTM EBITDA

- 1,000 TEV (10x TEV / LTM EBITDA)

- 60% debt / 40% equity

Performance

- 5-year hold

- 20% EBITDA growth

- 40% debt paydown

As you can see, even relatively small changes in the multiple can dramatically impact returns.

Here’s the Excel backup.

And to learn more about the drivers of LBO returns, check out our LBO value creation article.

Word to the wise

When evaluating potential investments, people sometimes mistakenly talk about multiple expansion as an independent variable. Ex: But if we get some multiple expansion, it could be a real winner…

In almost all cases, however, the multiple is highly correlated with the success of the business. Does the company have strong growth prospects? Are its margins attractive? Etc. If the business is doing well, folks are willing to pay a higher price (multiple). Therefore, it is best to consider the exit multiple a highly correlated booster or detractor from returns. If the deal goes well, and the company is more attractive than it was 5 years ago, someone might pay a higher multiple. Yay, multiple expansion! The inverse is also true. But in both of these outcomes, the multiple is not some independent pinwheel of chance. It is highly dependent on the rest of the deal.

Manufacturing Multiple Expansion

So far, we’ve established that

- Multiple expansion is desirable and

- it’s correlated with the overall deal.

As investors, how can we manufacture multiple expansion, or ensure that our deals sell for higher multiples?

There are several ways outlined below:

1. Make sure the deal goes really well

Take care of everything else, and multiple expansion may follow. If a business is growing rapidly, its margins improve, and it has a strong management team – and you still want to sell? – yes, someone will pay richly.

This ties back to the second point above: the exit multiple, and therefore multiple expansion, is highly correlated with the overall success of the deal.

2. Buy low, sell high

Buying underpriced assets, when you’re confident in a recovery, is a straightforward way to get multiple expansion. For example, many investors, who bought during the trough of the recession in 2009 achieved eye-popping returns and multiple expansion when they exited.

Luck is obviously a big factor here. And people get it wrong, too.

3. Change the business mix

This requires great vision and execution, but can lead to a fantastic outcome. Some business models command higher multiples than others, because investors view them more favorably. For example, SaaS businesses are valued at much higher multiples than run-of-the-mill contract manufacturing businesses.

If you buy an asset, and gradually transform it into a higher-multiple business, you can achieve multiple expansion.

As an example, a private equity investor buys a contract manufacturing company with custom inventory software. Over the next 5 years, the company increases its software capabilities and grows that part of the business. Whether the investor chooses to sell the software and manufacturing business units separately, or together, the aggregate exit multiple should increase.

4. Sum-of-the-parts > the whole

This was more common in the old days. Private equity firms bought downtrodden conglomerates and chopped them into tasty morsels to sell. By splitting them into bite-size pieces, the private equity firms realized higher weighted-average exit multiples (Ta-da - multiple expansion!).

This plan can still be executed today, but folks are wiser, and activist public markets investors often get there before private equity firms do.

Conclusion

Now you have a thorough understanding of what multiple expansion means and its connotations. If not, please send us a nasty email.

Remember, whenever someone waves around multiple expansion like a magic wand, be skeptical. It’s hard to execute and often requires a good deal of luck.