Introduction

Taxes are an important consideration in most transactions, especially for deal structuring. Unfortunately, many finance professionals (bankers and PE investors) are unnecessarily intimidated by the subject. While the legal minutiae are best left to the experts, understanding core tax concepts and being able to think (and speak) intelligently about tax structuring are within every deal professional’s grasp.

This article will be the first in a series of articles exploring important tax concepts for finance professionals, including (in no particular order):

- asset acquisitions vs. stock acquisitions

- valuing tax assets (e.g., NOLs)

- tax-free transactions

Before we get to the fun stuff, however, we need to review some core concepts. These will build the foundation for thinking about tax structuring and researching problems that you haven’t encountered before.

First Principles

- The US government wants a piece of every dollar of profit.

- In order to make calculating profit straightforward, the government usually waits until the profit has been realized, i.e., a transaction has occurred.

- Deductions, or other forms of tax shields, are a depletable resource. They can only be used once.

Basis, Basis Everywhere

The concept of basis is critical to understanding tax – and deal structuring. Basis is the amount you invested in acquiring an asset. It’s how much you paid for it. Going back to the first principles above, you need to know how much something cost in order to determine your profit, which the government will take a piece of.

Simple Example: Buying Stock

- Year 1: You pay $10 per share for 10 shares ($100 aggregate basis).

- Year 2: The shares are worth $20 per share. You still have an aggregate basis of $100, and you have an unrealized gain of $100.

- Year 3: You sell half your shares for $250. Half of your basis is $50. Therefore, you have a profit of $200 ($250 - $50), which you pay taxes on. Your basis in the remaining shares is $50.

First Principles: You pay taxes when your profit is realized. Your basis is how much you invested.

Next, let’s check out a slightly more complex example.

More Complex Example: Depreciation

- Year 1: Company A buys a factory for $100. Basis is $100.

- Year 2: Company A deducts $20 of depreciation from taxable income (depreciation is tax-deductible). Basis is $80.

- Year 3: Company A deducts $20 of depreciation from taxable income. Basis is $60.

- End of Year 3: Company A sells the factory for $80. It realizes a taxable profit of $20 ($80 of gross proceeds - $60 basis).

First Principles: You pay taxes when your profit is realized. Basis is how much you invested, but a given tax shield may only be used once. Since Company A deducted depreciation, when the company sold the factory, it had a lower basis, and the company faced a larger taxable gain.

P.S. If you wish to go deeper down the rabbit hole, research tax depreciation, a tricky subject that is even trickier to model. Tax depreciation does not conform to GAAP or IFRS depreciation formulas. The IRS has its own nuanced rules, which you can read about here. The depreciation rates (MACRS) can be found starting on page 71.

The Corporate Shell (a.k.a. the marble bag)

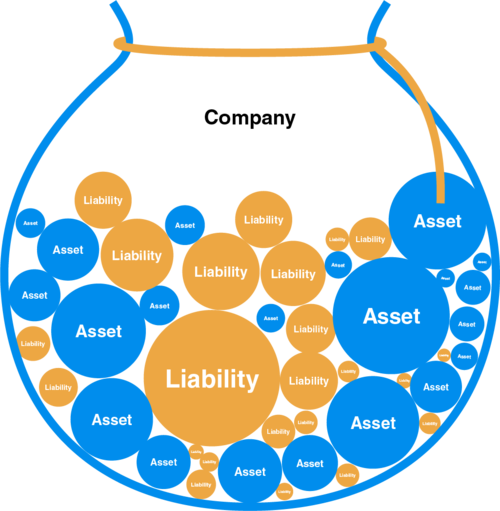

Now that you understand the concept of basis, let’s establish a new model for thinking about companies (from a legal / tax perspective): the corporate shell. Companies are really shells, which own/contain a collection of assets and liabilities. Companies have basis in each owned asset – even if that basis is quite low (many companies have depreciated some of their assets to a basis of $0). The image below is a good illustration of the corporate shell (a.k.a. the marble bag).

Companies can come in a variety of legal forms (partnerships, LLCs, corporations, etc.). We won’t cover the (dis)advantages of these variations here - you can find many good overviews elsewhere. For example:

The important part is reframing your mental model of companies. If you’re like me, you may have started out thinking of companies as amorphous blobs, but it’s better to picture them as shells containing a collection of individual assets and liabilties. Shareholders have basis in their shares, and companies have basis in their assets.

To be continued…