Introduction

If you have not read Tax Principles (part 1) yet, please start there.

–

Now that you have a basic legal / tax model for corporate entities, let’s begin looking at specific tax assets. We’ll start with Net Operating Losses, commonly referred to as NOLs. NOLs are exactly what they sound like - losses accrued over time.

Why are NOLs valuable? Because subject to certain restrictions, corporations can use NOLs to shield taxable income, i.e., avoid paying taxes. Going back to our first principles, the US goverment wants a piece of every dollar of profit. Corporations and corporate profits, however, are not one-and-done transactions. Companies often make investments that span multiple years, and then reap the profits over ensuing years and possibly decades.

Example: consider a startup consumer products company that must invest heavily in its brand in the early years. It may incur losses for several years, before sales catch up to advertising expenses. The company would have no taxable income in the early years (losing money every year), and then it would be hit with a full tax bill once the business starts to turn around.

Instead, NOLs provide a mechanism to balance out profits and losses over the years. A company that loses money in one year can carry over those losses to offset future profits.

Basic Rules

- NOLs can be carried back to the preceding 2 tax years and applied for an immediate tax rebate; or they can be carried forward for the next 20 years.

- After 20 years, any remaining NOL balance is canceled.

- Going back to our first principles, tax assets are depletable resources, so NOLs can only be used once.

Valuing a Standalone Company’s NOLs

You can value NOLs using a simple DCF. Like any other DCF, the key inputs are the cash flows and the discount rate.

Determining the Cash Flows

Let’s start with the cash flows. Assuming you’re valuing a company’s existing NOL balance (no new NOLs are created), the balance is a wasting asset. It grows smaller with use and eventually will be fully exhausted or canceled. The annual use of NOLs are a function of the company’s profitability. If the company is projected to be highly profitable, it will be able to use the NOL balance more quickly, and vice versa. To calculate the annual cash flow, the formula is simple:

Annual cash value of NOL = taxes shielded = NOL balance used x Tax Rate

Obviously, the value of the NOLs increases if the company is able to use them more quickly (time value of money).

What discount rate should we use?

That is subject to disagreement, duh. Many finance professionals like to use artificially low discount rates, because they argue that the risk is quite low (not comparable to equity risk). This has the fortunate effect of making the calculated asset value higher than it would be if one were to use a higher discount rate.

While a low rate may be appropriate in select cases, I think a more appropriate discount rate is somewhere between the company’s cost of debt and its cost of equity. Look at the order of payments in the income statement. First comes interest expense, then taxes, and last net income. Interest expense is a pretax item. Therefore, debtholders are paid before the government, and tax payments can be considered riskier than debt payments. The government, however, is paid before net income and shareholders. Therefore, the discount rate should reflect the relative risk - it should be between the cost of debt and the cost of equity.

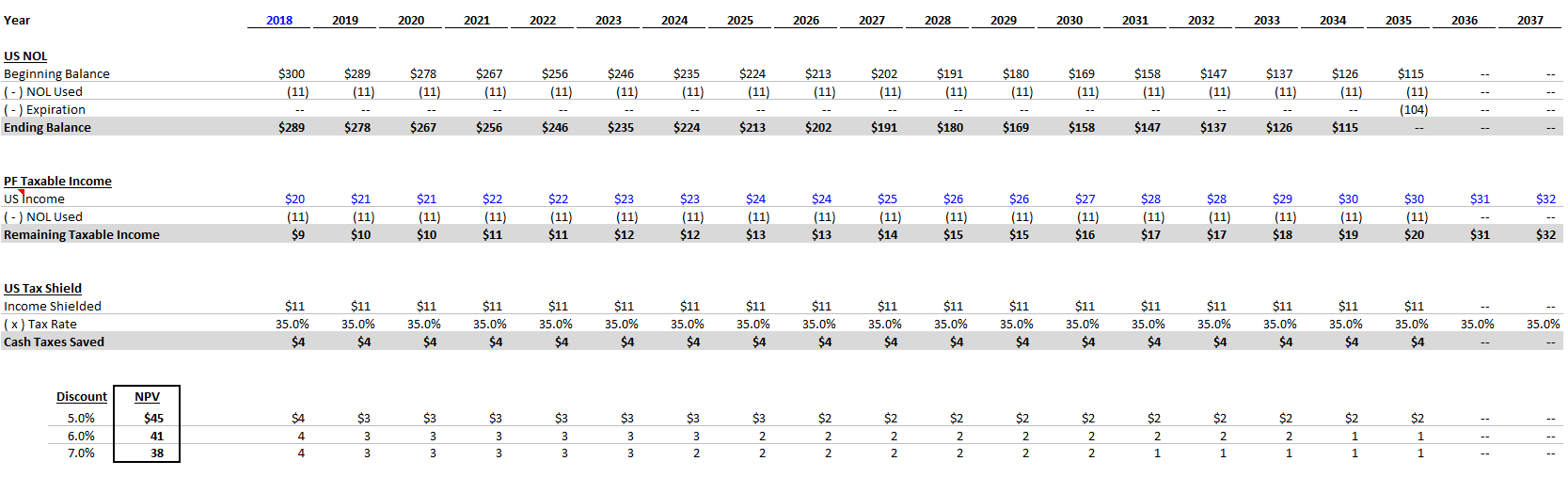

Sample DCF Output

Below is a sample DCF output, showing the build to cash taxes saved. Here is the full excel file (containing this output and the rest of the outputs from this article).

Standalone NOL Valuation Gotchas

- Do not double-count the value of the NOLs by valuing them separately if they’re already baked into the company’s projected cash taxes paid. Rule of thumb: if you’re valuing the NOLs separately, do not include them in your main corporate DCF.

- If you value the NOLs separately, the timing of projected tax shields (via NOL) must be consistent with the company’s projected income.

- If you are going to the trouble of valuing a company’s tax assets, you should pay attention to jurisdiction. In public filings, especially if the NOLs are material, companies often disclose a breakdown by jurisdiction. You can also usually get the company’s approximate operating income in those jurisdictions. NOLs should only be used to offset income in the matching jurisdiction.

- Tying into the item above, different tax jurisdictions have different rules. The approach discussed in this article is US-centric. Not all jurisdictions are the same. Do some googling.

Valuing an Acquisition Target’s NOLs

As you might imagine, tax assets make tasty snacks. Unfortunately, the IRS wants to limit the trafficking of NOLs - cases where corporate shells are purchased solely for the residual tax assets. Enter Section 382 of the Internal Revenue Code (IRC).

Section 382

I’m only mentioning the IRC section here so that if someone references it, you’re not lost. The important part is understanding the rule, which is simple: acquired NOLs are subject to a maximum annual use constraint, which is referred to as the Section 382 Limitation.

Section 382 Limitation = Fair Market Value of AcquiredCo x “Federal Long-Term Tax-Exempt Rate”

The Federal Long-Term Tax-Exempt Rate is one of several rates that the IRS publishes periodically and is used in many similar tax calculations. You can find the latest rate on the IRS website. Generally though, if you google “Federal Long Term Tax Exempt Rate,” you can find it pretty quickly.

For financial modeling purposes, you can assume the FMV of AcquiredCo equals the calculated equity value in your acquisition analysis (enterprise value - net debt). The tax definition of the FMV can be more complicated, and there are nuanced games that can be played to manipulate the value. The acquiror wants the FMV to be deemed as high as possible for tax purposes, so that they can use more of the acquired NOLs, more quickly.

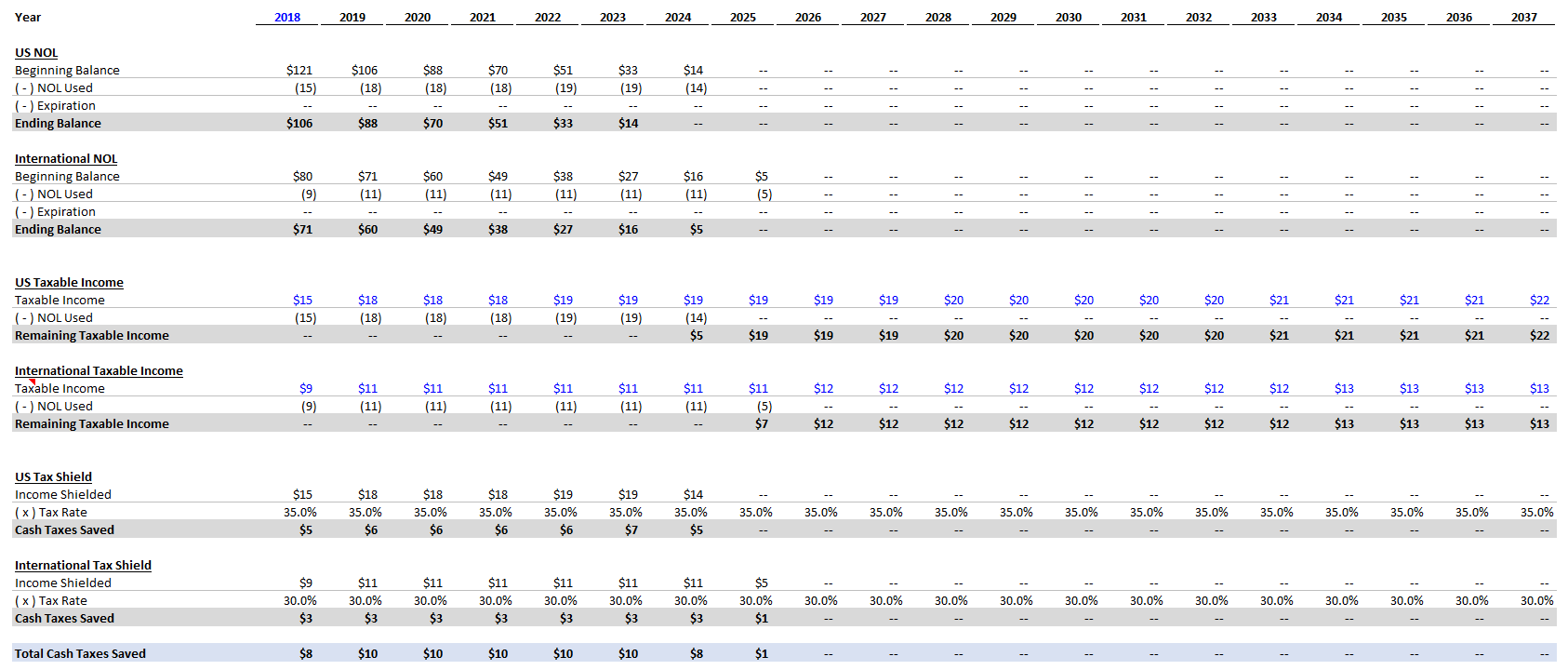

Below is an example valuation analysis of an acquired company’s US NOL balance. Here is the Excel file if you didn’t already download it.