Introduction

Ah, the dividend recap. It’s one of those phrases attached to private equity that gets tossed around without much explanation. You’ve probably heard the phrase, maybe read a DealBook article, but never worked on one. You may have some questions:

- What is a dividend recap?

- When and why would a financial sponsor pursue a dividend recap transaction?

- How should we model a dividend recap?

This article will strive to answer these questions in order.

1. What is a dividend recap?

‘Dividend recap’ is short for ‘Dividend Recapitalization,’ so it’s a recapitalization transaction + a dividend.

Great, what’s a recapitalization transaction? A recapitalization is when a company’s capital structure (the mix of debt and equity and other sources of capital) is adjusted.

Financial sponsors use dividend recaps as one of their many tricks to boost returns. Typically, sponsor-backed companies have a sizable debt load, and all excess cash flow is used to pay down debt. A dividend recap enables the sponsor to pay themselves a dividend before paying down the debt.

Wouldn’t debt covenants prevent that? They would. That’s where the recapitalization piece comes into play. In order to free the company from the restrictive debt currently in place, the sponsor refinances some or all of the company’s outstanding debt. The new debt is used to (a) repay the old debt and (b) finance a dividend to the sponsor.

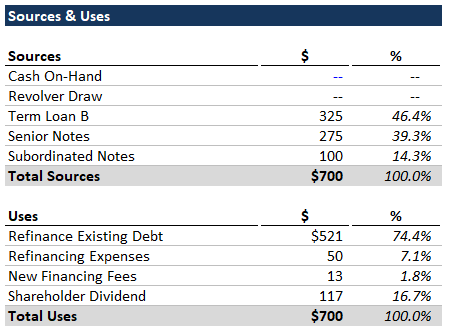

Below is an illustrative sources & uses for a dividend recap transaction:

Note the refinancing costs - these can be quite expensive depending on the type of debt that the sponsor-backed company has in place. Some types of debt include a penalty for early repayment, and generally speaking, bonds are much more punitive than bank debt.

2. When and why would a financial sponsor pursue a dividend recap?

A number of criteria must align for dividend recaps to make sense - these are outlined below:

1. The company has capacity for (significantly) more debt. When the company raises new debt, it must first pay back the existing debt, along with fees, and then whatever’s left over can be paid out as a dividend. If the company cannot raise meaningfully more debt, why bother?

2. Credit markets are favorable and willing. In tightening credit markets, investors don’t look favorably upon this type of transaction. In bouyant markets, (1) debt investors tolerate more leverage, and (2) cheaper interest expense means a company can service a bigger debt load (all else equal).

3. Credit markets have improved since the company’s original debt issuance. This is a nice-to-have. Improved credit conditions make dividend recaps more favorable (they make the math work better), because there is more value in the refinancing piece of the transaction. A company may save money by replacing expensive debt (higher interest expense) with cheaper debt.

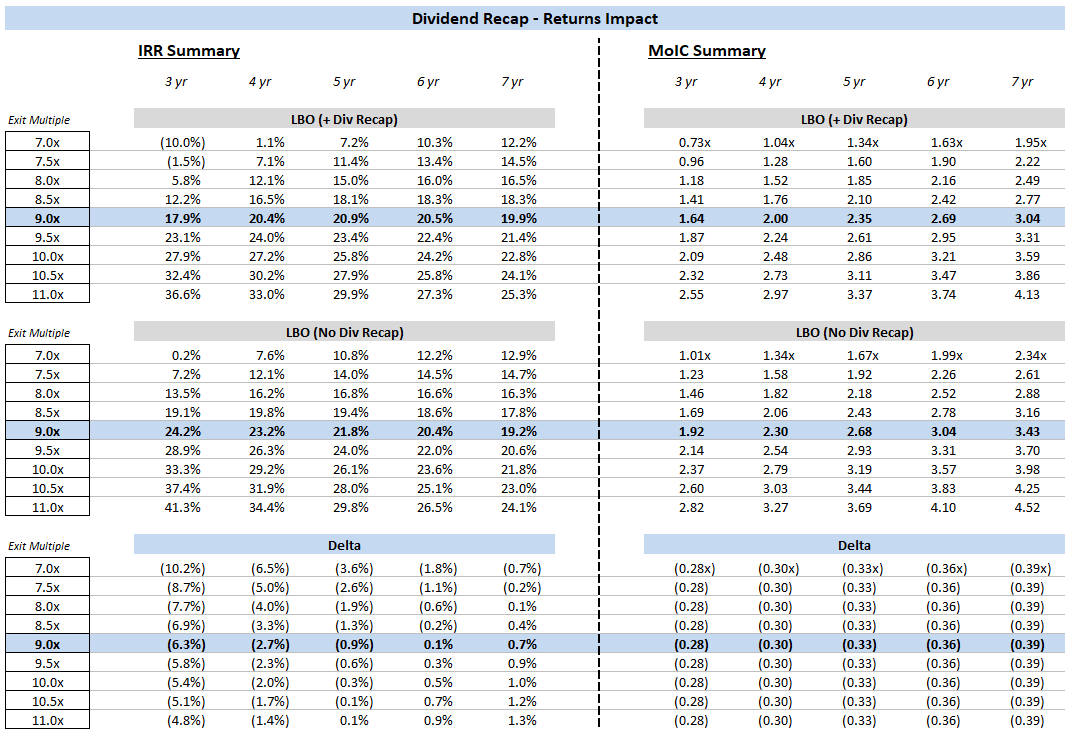

Below is a comparison of sponsor returns - with and without a dividend recap. We’re assuming $50mm in refinancing costs and the same financing terms as the original LBO. As you can see, given those assumptions, a dividend recap is not helping returns. You can play around with the assumptions and see the returns impact. Model attached.

Other Considerations

1. Taking money off the table. While dividend recaps generally increase a company’s financial leverage, they may decrease the total investment risk, because they allow the sponsor to immediately recoup some of their initial investment. There have been a number of cases in which sponsors recouped their entire investment via dividend recap and then later sold the company for extra $$$.

2. Fundraising Optics. If a sponsor is in the midst of fundraising, dividend recaps can help weave a story of “high-performing recent investments.” The total outcome is unknown until the sponsor exits, but a dividend recap can help signal that things are going well.

3. Sponsor can’t find an attractive exit and wants to buy some time. This one is pretty self-explanatory.

3. How should we model a dividend recap?

First, what is our modeling objective?

- We want to add dividend recap functionality to an existing LBO model.

- We want to be able to toggle it on and off.

- We want to be able to choose the year in which we perform the dividend recap.

Next, some simplifying assumptions:

- If we perform a dividend recap, we refinance all existing debt.

- Same credit terms and structure as the original debt issuance, but you are free to adjust.

- For the selected year, the dividend recap occurs at the very end of the year.

Like any modeling exercise, we need to break this into pieces. There’s the dividend and the recapitalization. The dividend is easy to model - a reduction in shareholder’s equity and a few adjustments to the investor returns calculations.

The recapitalization is more complicated. We need to dynamically calculate debt capacity and sources & uses based on the LTM EBITDA for the selected year. Then, we need to add the refinancing and new debt line items to the debt and interest expense schedules.

Download the following files:

- LBO Model (no Div Recap) - base LBO model, which we’ll use to build the dividend recap functionality.

- Completed Model (w/ Div Recap) - for your reference. This Excel file includes a tab for each step of the tutorial.

If the LBO looks overwhelming, pause and work through our LBO modeling tutorial.

The steps/instructions below are meant to accompany the completed Excel file.

Step 1. Build out new Sources & Uses and transaction assumptions.

- Add Dividend Recap controls to the main Transaction Assumptions section. Remember - we want to be able to (a) toggle the dividend recap on and off and (b) pick the year.

- Create a new Dividend Recap Transaction Summary section beneath the Transaction Assumptions section. Just like the debt financing for the main LBO transaction, all debt raised will be based on the LTM Adj. EBITDA - but for which year? This is where it gets tricky.

- The first piece of the Dividend Recap Transaction Summary should be a Key Metrics section where we specify the LTM Adj. EBITDA and the total debt to be refinanced. See if you can come up with a formula for the correct EBITDA using the Excel offset() function and the assumed year of the dividend recap.

- Next calculate the debt raised (based on leverage multiples) and associated financing fees.

- Fill out the Sources and Uses. Assume $50mm of debt refinancing costs (purely illustrative). In real life, you’d be able to calculate the exact fee based on the bond indentures or other debt agreements.

Step 2. Add new debt line items to the Debt Schedule.

Now we need to expand the Debt Schedule to accomodate the new debt tranches. Under Ending Debt Balance, Mandatory Amortization Schedule, Mandatory Amortization, and Optional Prepayment, create new rows for the debt raised under the dividend recap. The one exception is the revolver. No need to replicate that – we assume it is refinanced at exactly the same terms as the original issuance.

Be careful with the total formulas for each section. Also, the starting debt balances for the dividend recap tranches can be set to 0 for now.

Step 3. Add new debt line items to the Interest Expense Schedule & update Credit Metrics.

- Similarly, add rows for the new debt tranches and be careful with sum formulas.

- For amortization of deferred financing fees, you can link the total fees to the Dividend Recap Sources & Uses, but the amortization should be 0 if the transaction is toggled off, or if the given year is before the year of the recap.

- Likewise, be careful with the formula for PIK interest expense. Consult the completed file.

- Update the Credit Metrics. Change the formulas for the Senior Secured Debt, Senior Debt & Total Debt rows to include the new debt tranches.

Step 4. Build Adjusting Line Items Schedule.

Next we need to integrate the dividend recap with the rest of the model. The debt schedule functions, but all of the new debt tranches should be 0, since we haven’t dynamically linked the starting balances.

Create a new section underneath the Dividend Recap Transaction Summary, entitled Dividend Recap Adjusting Line Items. Here we’re going to create an adjustment row for each item affected by the transaction. If we need a reminder on which line items these should be, let’s look at the Sources & Uses:

- existing debt tranches refinanced

- new debt tranches added

- refinancing costs and dividend reduce shareholders’ equity

- new financing fees capitalized in other noncurrent assets

When calculating the debt to be refinanced, you basically need to duplicate the calculations under Ending Debt Balance in the Debt Schedule, because we’re going to subtract this (calculated) amount in the Ending Debt Balance section. If we just linked to the Ending Debt Balance, we’d have a nasty circularity.

Term Loan Ending Balance = Beginning Balance - Mandatory Amortization - Optional Prepayment

Notes Ending Balance = Beginning Balance - Mandatory Amortization - Optional Prepayment + PIK

Once you have the debt to be refinanced, add it back to the Dividend Recap Sources & Uses. The rest of the calculations should be relatively straightforward.

Step 5. Incorporate adjusting line items.

Now we need to incorporate the adjusting line items in the rest of the model.

1. Add debt refinancing and new debt tranches.

We need to add the debt refinancing and the new debt tranches to the Debt Schedule. In the Ending Debt Balance calculation for the original LBO debt tranches, subtract the refinanced debt (which should equal the sum of other items). Therefore, if the dividend recap is toggled, the Ending Debt Balance for these tranches should be 0 in the year of the recap.

For the new tranches, do the opposite. Add the amount of issued debt to the Ending Debt Balance calculation.

Now you should see a distinct pattern in the Ending Debt Balance section. In the year of the recap, the LBO tranches are set to 0, and the recap tranches appear. The recap tranches delever thereafter.

The interest expense schedule should update automatically, but scan through it. It’s an easy way to catch any sloppy sum formulas.

2. Balance Sheet Adjustments

Add capitalized financing fees to Other Noncurrent Assets.

Subtract refinancing costs and the dividend from Shareholders’ Equity.

Step 6. Adjust returns calculations.

I’ll summarize, and you can try to implement these changes yourself, and then reference our completed version.

- The dividend amount needs to be added to the numerator in MoIC calculations for all years after (and including) the year of the dividend recap.

- IRR - you need to add a separate cash flow schedule (with a corresponding IRR calculation) for each exit year. Since the sponsor is receiving cash flows in multiple periods (they get the dividend one year and sale proceeds another year), the typical IRR formula (using MoIC) no longer works.

Use the XIRR() function for the IRR calculations, and you can combine the results for each exit period in a single table - mirroring the format we had prior to the dividend recap.

Next Steps

If you really want to see the returns impact, you should examine multiple sets of financing assumptions. Rig up a few financing cases for the dividend recap (improved case, worse case) and vary those along with the refinancing costs.

Try the rest of our private equity modeling tutorials: