1. Introduction

How much can a financial sponsor afford to pay?

This is the question that an ability-to-pay analysis strives to answer. On the sellside, bankers use this analysis to frame sponsor bids. On the buyside, sponsors perform similar sensitivity analyses when determining potential bids. The key assumptions are the operating projections and the financing case.

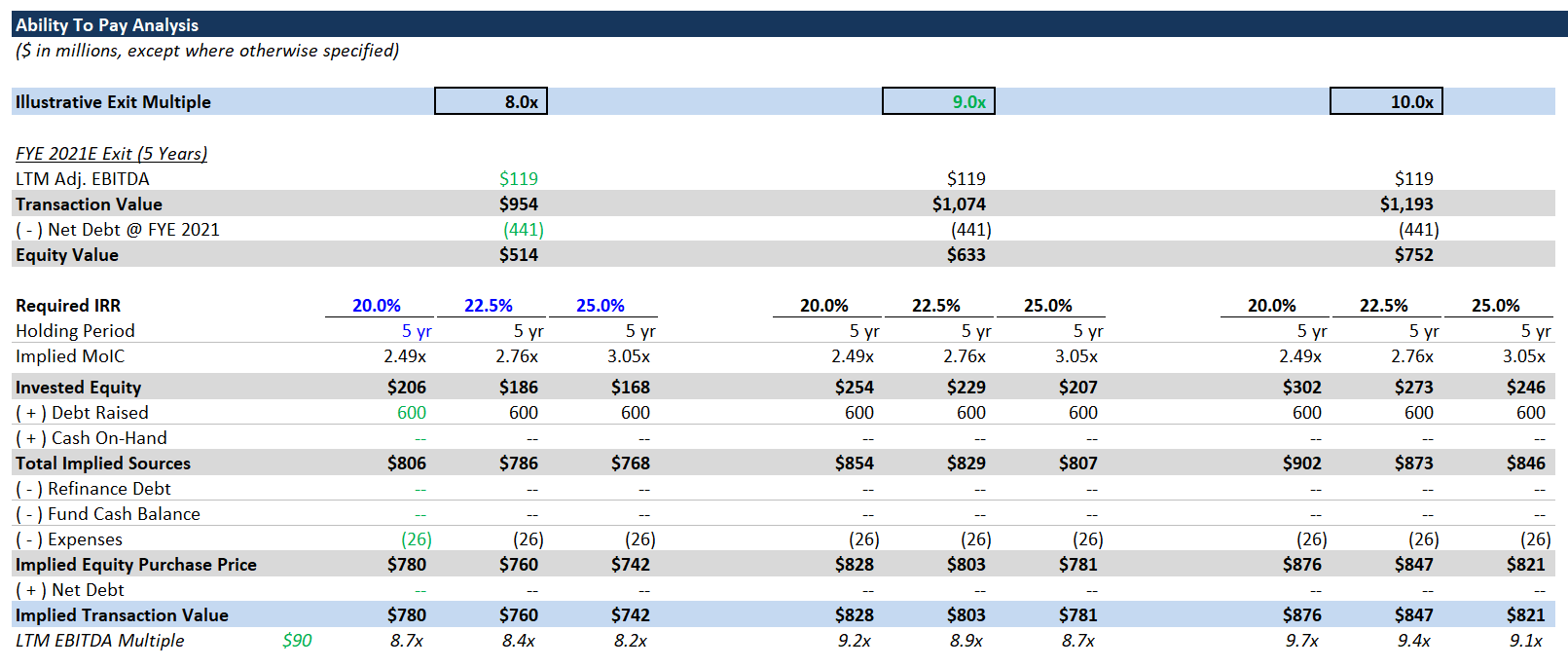

Here is what the completed analysis looks like:

Try to build the ability-to-pay analysis on your own, but you can use this completed version as a reference.

2. Calculate Equity Invested

You should build your ability-to-pay analysis after building your LBO, because many of the key inputs come directly from the LBO.

The key concept to understand is: in an ability-to-pay analysis, you work backwards.

What does that mean?

Well, we know most sponsors have an IRR threshold of 20% - 25%. They won’t be interested in a transaction if they don’t expect to achieve an IRR within that range. Since we’re taking the current operating case as a given, we know the 5-year projected EBITDA, so we can calculate the transaction value at exit. We have the assumed financing case as well, so we know what the cumulative debt paydown and future net debt will be.

Equity Value = Transaction Value - Net Debt

Using the projected EBITDA and a range of exit multiples, calculate the implied transaction value at exit. Then, subtract future net debt (at exit) to derive the future equity proceeds to the sponsors.

Next, using the IRR threshold (20% - 25%), calculate the maximum equity check size. There are a couple ways to do this:

Option 1

Max Equity Invested = Equity Value @ Exit / (1 + IRR) ^ 5

Option 2

Calculate the MoIC as an intermediate step. MoIC = (1 + IRR) ^ 5

Then divide future equity value by MoIC. It’s the same thing, just broken into 2 steps.

Now we have the maximum equity check size, but we need to calculate the implied entry multiple.

3. Calculate Total Sources

To go from maximum equity investment to implied entry multiple, we need to back out the sources and uses. Given our cash-free, debt-free transaction, this is pretty simple, but it can be more complicated.

In addition to the calculated sponsor investment, we have the debt financing assumptions from the LBO. Since we’ve been lumping management rollover and sponsor equity together for returns calculations, we don’t need to add the management rollover amount. It’s implicitly included in the maximum equity investment.

Calculate total sources:

Total Sources = Maximum Equity Investment + Total Debt Raised

4. Implied Transaction Multiple

Next, let’s subtract any refinanced debt (there is none) and expenses. All remaining sources of cash can go towards the equity purchase price. Combining the equity purchase price with net debt, we get the implied transaction value (here, equal to equity purchase price). Divide by 2016A Adj. EBITDA to derive the entry multiple.

Note: we could have subtracted transaction expenses from total sources to calculate the implied transaction value, but we wanted to lay out all of the sources & uses line items.

5. Check Your Work

There’s a neat way to check your work: You can plug the implied transaction multiple back into the LBO as the entry multiple, and the calculated IRR (in the Sponsor Returns section) should exactly match the corresponding IRR threshold.

Example: Use the implied entry multiple assuming a 20% IRR over 5 years and a LTM exit multiple of 9.0x. If you plug that implied entry multiple into the Transaction Assumptions section, the 5-year IRR should be exactly 20.0%.

If yours doesn’t match, double check your model against the provided Excel file.

6. Next Steps

Try the rest of our private equity modeling tutorials: