Introduction

When you finish your LBO model and calculate a juicy IRR, that feels good. But what does that IRR represent? How much money is the sponsor making vs. the management team? How does that split change based on the success of the deal?

This post will strive to address these questions. But - if you haven’t worked through our preceding private equity tutorials (listed below), please review those first.

High Level

Essentially, we’re talking about the equity waterfall, which is the division of equity proceeds amongst all the different equity holders.

You may have thought that equity was just one amorphous blob, where everyone is equal – I know I did at first. That is not the case. The division of proceeds amongst different classes of stock and investors can be as tricky as debt waterfalls (for more on debt waterfalls, check out our Intermediate LBO Guide).

OK, if the equity waterfall is so nuanced, why do most banker LBO models treat all shareholders the same? Because the division of equity proceeds is bespoke to each deal, and frankly, treating all shareholders as one unit is a good approximation. For a pitch, you generally just want to know if the sponsor returns pass the smell test (minimum 20% IRR for a vanilla financial sponsor).

Takeaway: For bankers, the equity waterfall for a private equity deal usually doesn’t matter. It is crucial, however, for the financial sponsor and their partner management team.

Why is the equity split bespoke?

For each private equity deal, management’s compensation package (and the equity split) is heavily negotiated. Many different factors can influence these negotiations; below are some of the most important considerations:

Relative value of the management team

- Are they the best in the industry, or just hoping to keep their jobs?

- Can the asset be operated without this team?

- Would the sponsor do the deal without this team?

Sale process dynamics

- How many other credible sponsors are bidding?

- Is this a must-sell-now situation, or can the seller afford to wait if no amenable bids come along?

PE firm size / culture / social issues

- How large is the private equity firm?

- How flexible is the private equity firm?

- How junior is the partner leading the deal?

Influenced by these variables, and many more, the sponsor and the management team will negotiate an equity package - basically, management’s piece of the pie. This will form the bulk of management’s total compensation, and it will be structured to align incentives.

The sponsor wants to keep management’s compensation as low as possible, while (a) maintaining a cordial and productive working relationship and (b) incentivizing the team. Meanwhile, management wants to grab as much equity as they can.

Example Equity Waterfall

Here is the completed Excel file, which builds off of our preceding tutorials. We’ll be discussing the Equity Waterfall tab.

Key Assumptions

- Single sponsor deal

- Sponsor uses preferred stock with an accruing hurdle rate

- Preferred stock converts to common on a 1-1 basis

- Management compensation structured with stock options

Let’s discuss each of these in more detail.

Single sponsor deal

There are no coinvestors or other complicating factors. This is about as simple as it comes (one sponsor partnering with a management team).

Preferred stock with a hurdle rate

- Sponsor uses preferred stock to protect against downside risk. Preferred stock is senior to common equity, so if the deal goes sour, the sponsor would be paid in full before the management team.

- Hurdle rate allows the sponsor to accrue some minimum return threshold (essentially, before the management team is paid). This feels a little nasty, but you can understand the rationale: if the sponsor only makes a 2% return, the management team did a bad job and shouldn’t get paid.

- Here, we’re assuming an 8% hurdle rate.

Convertible preferred

- The preferred stock is convertible to common stock. If the deal goes well, the sponsor can convert its preferred stock to common stock and share in the upside.

- Also, since the sponsor has been accruing the hurdle rate, the sponsor receives more common stock than its initial investment would warrant.

Stock options

- We’ve structured management’s compensation using a series of stock options with progressively higher strike prices. As the exit value increases (successful deal), management gets a bigger piece of the pie.

Enough chitchat, let’s review the actual model.

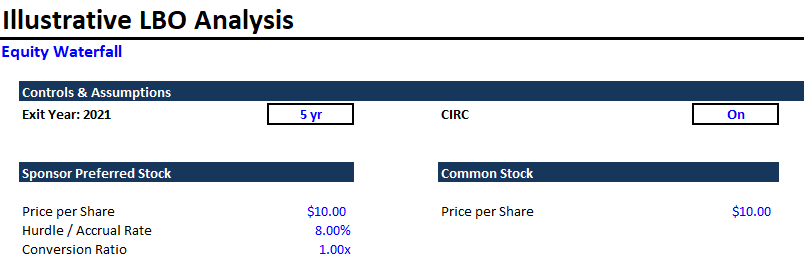

Controls & Assumptions

We don’t have many controls and assumptions.

A couple things to point out:

- You can change the exit year, to see how the payout changes for different holding periods.

- You can change the preferred acrrual rate and the conversion factor.

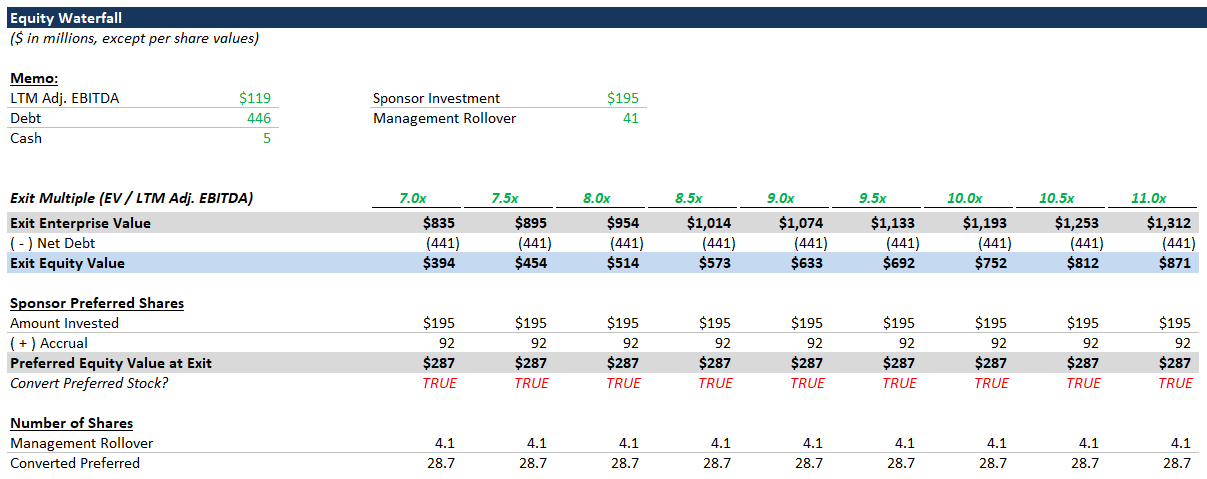

Equity Waterfall (part 1)

The top of the equity waterfall shows our build to equity value and calculates the value of the sponsor’s preferred stock (including the accrued hurdle rate). The sponsor will only convert the preferred stock if the value of received common stock is greater.

Here, we’re making a simplifying assumption that the sponsor converts as long as the total equity value is greater than the accrued preferred stock. Note: the mechanics of the conversion right would be negotiated.

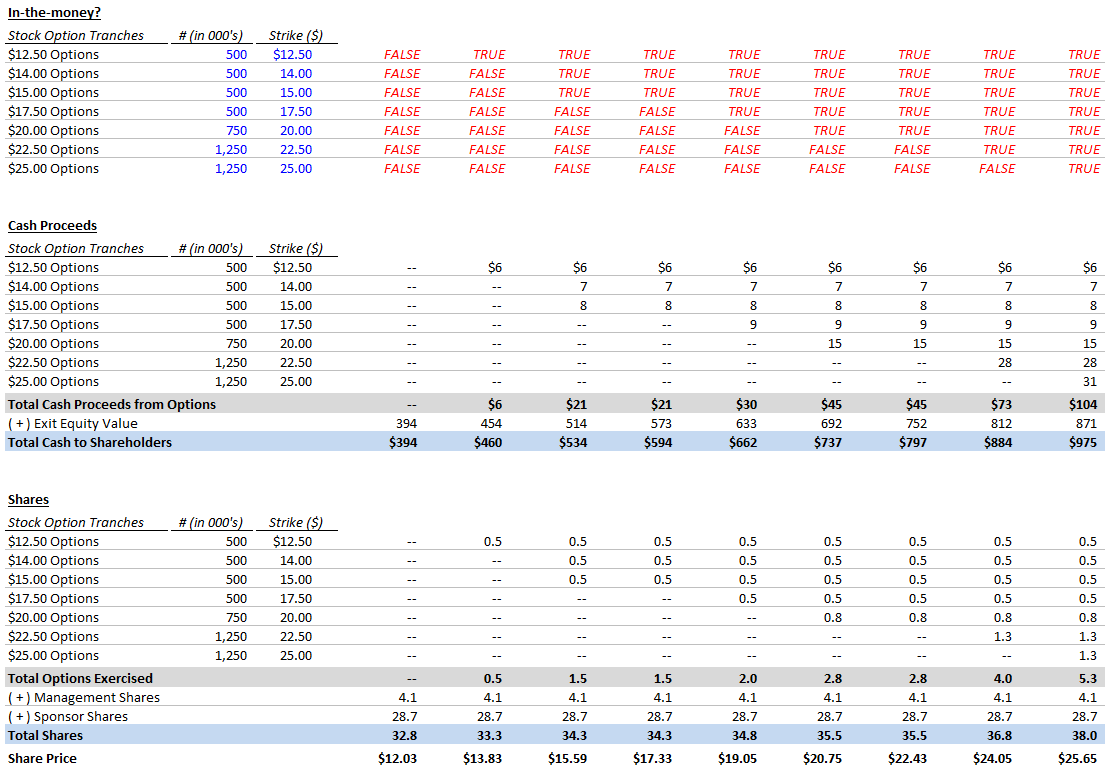

Equity Waterfall (part 2)

The remainder of the equity waterfall handles the management team’s stock options. We’ve structured 7 different tranches of options with progressively increasing strike prices. This aligns management’s incentives with the sponsor’s - management gets paid more as the sponsor makes more money.

You’ll notice that we add the option proceeds to the equity value. This is different from the treasury stock method, but it follows a similar logic. The money paid to exercise stock options becomes available to all equityholders, thereby increasing the equity value (whereas the treasury stock method assumes that the cash used to exercise options is used to repurchase shares).

As you’ve probably guessed, this creates a circular reference: The implied share price is based on the total number of shares, which includes exercised options, which in turn depends on the share price.

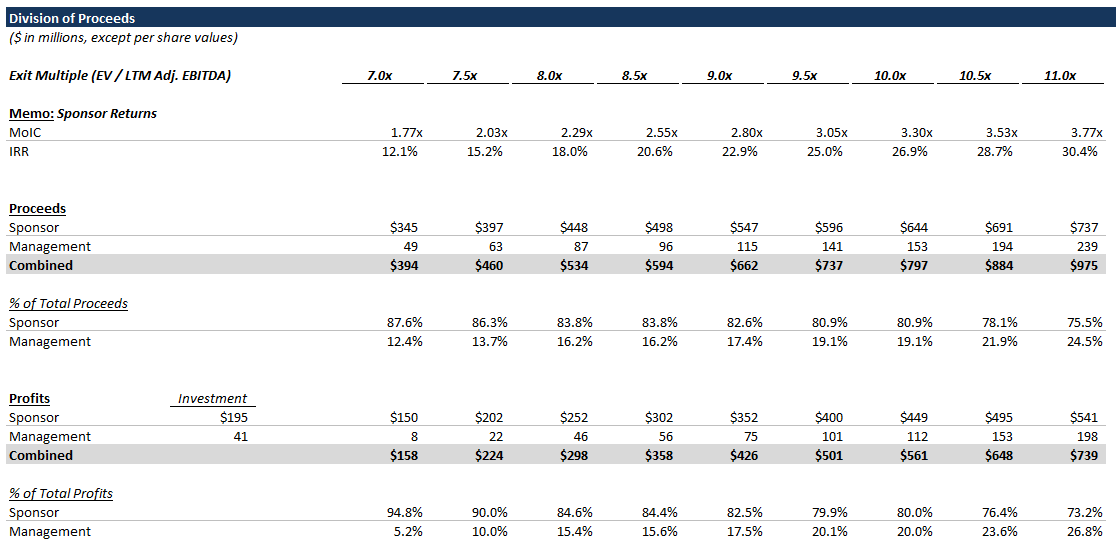

Division of Proceeds

Here, we calculate the sponsor’s returns: (i) IRR and (ii) Multiple of Invested Capital (MoIC). These return figures are different from those at the bottom of the LBO tab, because these figures isolate the sponsor’s returns vs. the aggregate shareholder returns.

The more important part of this section, however, is the division of proceeds and profits between management and the sponsor. You’ll notice that management’s split forms an upward-sloping curve - as the exit value gets higher, management gets a bigger piece of the pie.

This division of profits is a key negotiation point between the sponsor and management. The sponsor relies on the management team’s strategic plan and expertise to form projections for the business. Those projections are then used in the sponsor’s financial model to project returns. The sponsor also uses these projections when negotiating management’s compensation package. They essentially tell the management team: Hey, if you achieve your stated financial plan, you’ll be well paid.

Hence, the saying that management always sandbags their numbers - to manage expectations and get paid!