Introduction

This is going to be a shorter post. We’re going to explore the concept of unit economics - what it means, why unit economics are important, and a few examples.

I struggled to understand unit economics for an embarrassingly long time. I heard the term used in management presentations, by investors, by my bosses, and I never really got it. Oh yeah, the unit economics. Of course.

My hope is that this article will cure you of this problem or, if you’re already familiar with the concept, improve your understanding. So here goes.

Definition

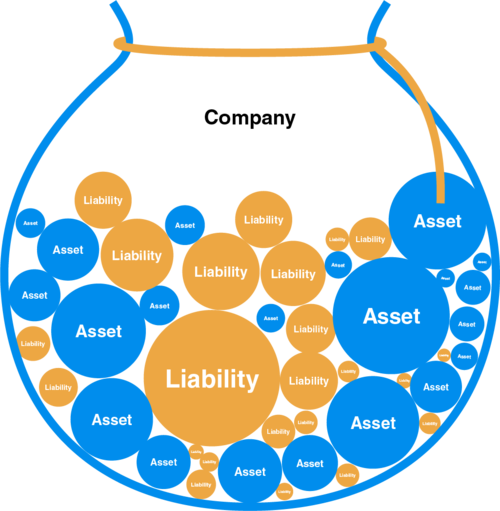

The term unit economics refers to the base unit of activity for a given business and the profitability / economics of that unit. Let’s break that down.

Unit economics consist of two conceptual pieces:

- the base unit of activity and

- the economics or profitability of that unit.

Base Unit of Activity

The base unit of activity for a given business is the smallest logical piece that helps you understand the business as a whole.

Below are some examples:

- For a retail company, like J.Crew, the smallest unit of business is an individual store.

- For an ecommerce company, like Amazon, the smallest unit of business is an individual online purchase (could consist of multiple items).

- For an ocean shipping company, with a fleet of ships, the smallest unit of business is an individual ship.

- For an upstream oil & gas company, the smallest unit of business is an individual well.

- For a home builder, the smallest unit of business is an individual home.

- For a SaaS business, the smallest unit of business is a subscription.

- For a power generation business, the smallest unit of business is a power plant.

Choosing the base unit(s) of activity requires some discretion. You must disaggregate how many base activities the company is engaged in. For example, many retailers are working to strengthen their ecommerce operations. You might choose to evaluate such a company as two separate businesses: (i) a physical retailer and (ii) a supplemental ecommerce business. The base unit of the retailer would be a single store, and the base unit of the ecommerce business would be a single transaction.

Likewise, maybe an oil and gas company is involved in two separate plays, each with its own well profile. Or perhaps a retailer has multiple distinct store formats. You might choose to evaluate each format as its own business line, with its own unit economics.

Profitability / Economics

The second step is understanding the economics for the selected base unit(s) of activity. You need to understand the revenue & expense drivers:

- What variables determine revenue? What do they depend on?

- What variables determine expenses?

- How fixed / variable is the cost structure?

You also need to understand any CapEx associated with the unit:

- Does this base unit require a big investment to build / bring online?

- How long does it take?

For example, power plants take a long time and a lot of money to build. But for the marginal software subscription, there’s no cost, and it could be instantaneous.

Unit economics encompass all the variables and information needed to build a simple financial model for the base unit(s) of activity.

Let’s look at some examples.

Retail

Financial drivers for a store:

- Sales per sq. ft. ($)

- Store size (sq. ft.)

- Build-out cost

- Rent, financing & other fixed costs

- Gross margin

Ecommerce

Financial drivers for a transaction:

- Transaction size ($)

- Gross margin

- Any attributed marketing spend (e.g., online ads)

Ocean Shipping

Financial drivers for a ship:

- Utilization percentage: what % of time is the ship under contract?

- Average fee / contracted day

- Fuel & other variable costs

- Maintenance costs & schedule

- Rent, financing & other fixed costs

Upstream Oil & Gas

Financial drivers for a well:

- Forecasted production curve (volume)

- Opex

- Capex

- Transport costs

- Oil / gas price

Software as a Service (SaaS)

Financial drivers:

- Churn / expected customer lifetime

- Customer acquisition cost (CAC)

- Price

- Any variable costs associated with subscription (e.g., dedicated support rep)

Power Generation

Financial drivers for a power plant:

- Forecasted production (volume)

- Price

- Variable production costs

- Maintenance costs & schedule

- Cost to build & timeline

- Financing & other fixed costs

Why Unit Economics Are Important

Unit economics help us think about the profitability and growth potential of a business.

Going back to our examples, a retail company is really just the sum of all its stores and some corporate overhead. Likewise, a shipping company is the sum of all its ships and some corporate overhead. You get the idea. Understand the part, and you understand the whole.

Furthermore, unit economics simplify a complex problem by providing a smaller surface area to examine. Forget the overall company - how profitable is one store?

If a company’s unit economics look great, but the overall financial profile is lackluster, that sounds like an investment with potential for improvement (and opportunity for multiple expansion).

If a company’s overall profile is fine, but the unit economics are rapidly degrading, that’s cause for alarm.

In Practice

Unit economics are an important tool for investors.

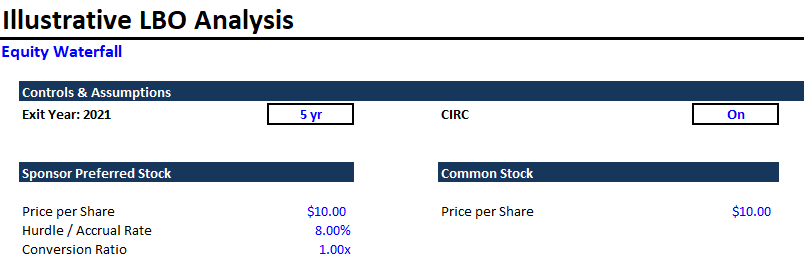

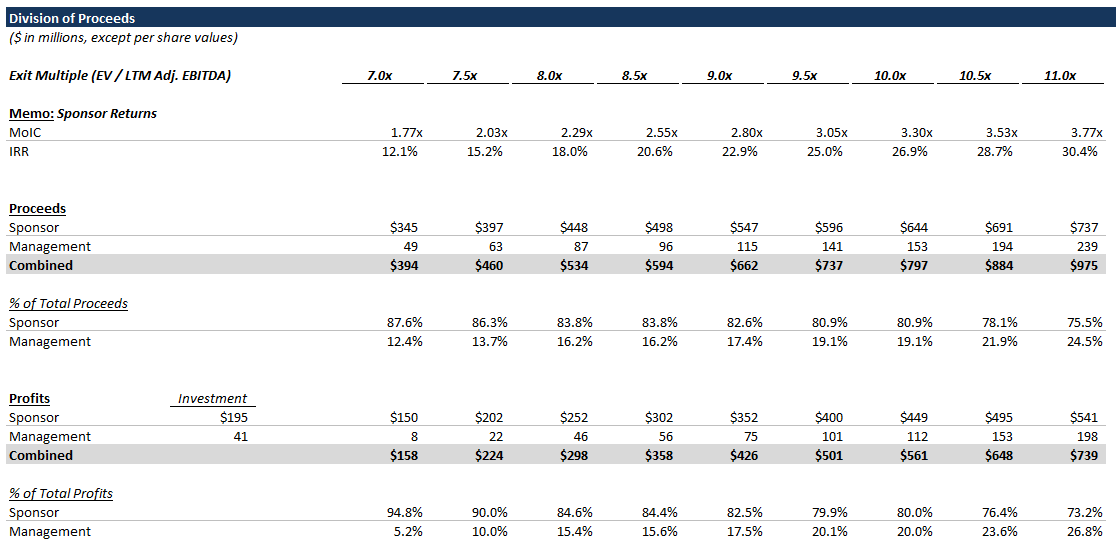

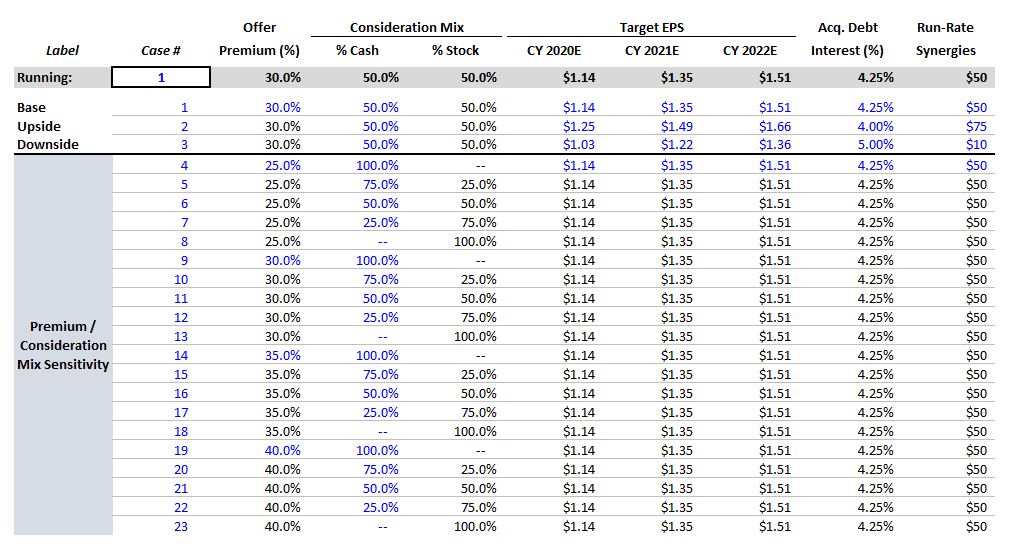

Private Equity

In private equity deals, a company’s unit economics are one of the major diligence items. If the unit economics look bad, that’s a dealbreaker!

Venture Capital

Since venture-funded businesses do not have much of a track record, understanding the unit economics and potential market size are crucial.

Public Markets

Investors try to determine the health of companies’ unit economics from public filings and other publicly available data. Understanding the unit economics is a key step in researching industries and forming a thesis.